The Aadhaar-Enabled Payment System (AePS) has gained significant attention in recent times, with concerns being raised about potential gaps in the system that cybercriminals exploit to steal funds from users’ bank accounts. In this article, we will explore the Aadhaar-Enabled Payment System, its benefits, and relevant details that are crucial for the Indian Administrative Services (IAS) exam’s Indian economy segment.

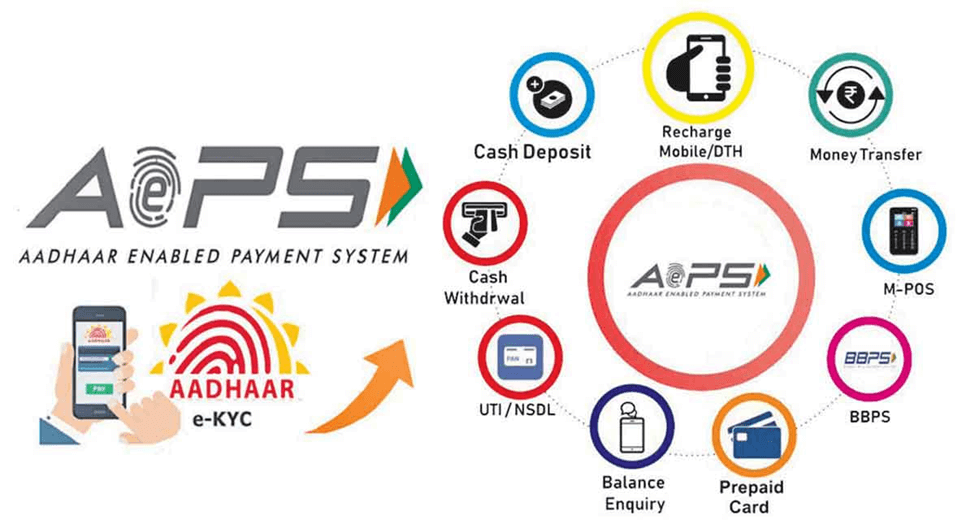

- Understanding Aadhaar-Enabled Payment System (AePS): The Aadhaar-Enabled Payment System (AePS) is a bank-led model that facilitates online financial transactions at Point-of-Sale (PoS) and Micro ATMs through the business correspondent of any bank, utilizing Aadhaar authentication. This innovative model eliminates the need for One-Time Passwords (OTPs), bank account details, and other financial information. Instead, it enables fund transfers using the bank name, Aadhaar number, and the fingerprint recorded during Aadhaar enrolment, as outlined by the National Payments Corporation of India (NCPI).

- Enabling AePS Transactions: While neither the Unique Identification Authority of India (UIDAI) nor NPCI explicitly states whether AePS is enabled by default, Cashless India, a website managed by MeitY, indicates that the service does not require any activation. The only prerequisite is that the user’s bank account should be linked with their Aadhaar number. Additionally, individuals seeking benefits or subsidies under Aadhaar Act’s section 7 schemes must mandatorily provide their Aadhaar number to the banking service provider. Consequently, since Aadhaar is the preferred method of Know Your Customer (KYC) for banking institutions, AePS is automatically enabled for most bank account holders.

- Ensuring Security for Aadhaar Biometric Information: To safeguard Aadhaar biometric information, the UIDAI is proposing an amendment to the Aadhaar (Sharing of Information) Regulations, 2016. This amendment will require entities possessing an Aadhaar number to refrain from sharing details unless the Aadhaar numbers have been redacted or blacked out through appropriate means, both in print and electronic formats. Moreover, the UIDAI has implemented a new two-factor authentication mechanism that employs a machine-learning-based security system, combining finger minutiae and finger image capture to verify the liveness of a fingerprint.

- Locking Aadhaar Biometric Information: Users are advised to lock their Aadhaar information through the UIDAI website or mobile app to enhance security. Locking Aadhaar ensures that even if the biometric information is compromised, it cannot be used to initiate financial transactions. However, Aadhaar can be unlocked when biometric authentication is required, such as for property registration or passport renewals, after which it can be locked again.

- Online Aadhaar Locking Process: To lock Aadhaar cards online, users can generate a 16-digit Virtual ID (VID) number via SMS service on the UIDAI website. Additionally, the My Aadhaar tab on the UIDAI website allows users to lock their Aadhaar biometric information conveniently.

Important Points:

- Aadhaar-Enabled Payment System (AePS) 🌐

- Bank-led model for online financial transactions 💸

- Utilizes Aadhaar authentication for Point-of-Sale and Micro ATMs 🏧

- Eliminates the need for OTPs and bank account details 🚫

- Benefits of AePS 📈

- Simplifies fund transfers using Aadhaar number and bank name 💳

- Reduces reliance on traditional financial information 💼

- Facilitates seamless transactions for Aadhaar Act schemes’ beneficiaries 🎁

- Security of Aadhaar biometric information 🔒

- Proposed amendment to prevent sharing of Aadhaar details without redaction 🚫📤

- Two-factor authentication with finger minutiae and image capture 🤚🔍

- Locking Aadhaar information to prevent unauthorized transactions 🔒

- Process of locking Aadhaar online 🔐

- Generate a 16-digit Virtual ID (VID) via SMS service on UIDAI website 📲

- Utilize the My Aadhaar tab on UIDAI website to lock biometric information 💻

- Importance of minimizing cyber fraud for digital India 🛡️

- Ensures maximum benefits from a digital ecosystem 💰

- Restores trust and confidence among users 🤝

Why In News

The Aadhaar-Enabled Payment System (AePS) has garnered attention due to concerns over alleged exploitation of system vulnerabilities by cybercriminals to illicitly siphon funds from users’ bank accounts. However, it is crucial to understand the Aadhaar-Enabled Payment System’s features, advantages, and its relevance to the IAS exam’s Indian economy segment.

MCQs about Aadhaar-Enabled Payment System (AePS) and Security Measures

-

What is the primary objective of the Aadhaar-Enabled Payment System (AePS)?

A. Simplifying fund transfers

B. Enhancing cybersecurity measures

C. Eliminating the need for biometric authentication

D. Reducing reliance on Aadhaar number

-

How can users secure their Aadhaar biometric information?

A. Sharing it only with trusted individuals

B. Regularly changing their Aadhaar number

C. Locking their Aadhaar information through the UIDAI website or app

D. Providing it to multiple entities for enhanced security

-

What is the proposed amendment to protect Aadhaar details?

A. Sharing Aadhaar details only through secure channels

B. Redacting or blacking out Aadhaar numbers before sharing

C. Allowing unrestricted sharing of Aadhaar information

D. Requiring Aadhaar authentication for every financial transaction

-

Why is minimizing cyber fraud important for digital India?

A. To enhance the convenience of financial transactions

B. To increase reliance on traditional financial methods

C. To ensure maximum benefits from the digital ecosystem

D. To discourage users from utilizing Aadhaar-based services

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()