With businesses increasingly relying on digital technology to operate, store data, and communicate with a more extensive customer base, they become more vulnerable to cybercrime. Cybersecurity breaches like data breaches and cyberattacks can cause significant losses and damages to businesses. As a result, businesses need to be proactive and prepare themselves for these kinds of risks. One way to do this is by getting cyber insurance.

What is Cyber Insurance?

Cyber insurance is a type of insurance product that protects businesses from internet-based threats affecting IT infrastructure, information governance, and information policy. It helps businesses mitigate the risk of cybercrime activities like cyberattacks and data breaches. Cyber insurance can cover the loss resulting from a data breach, provide coverage for lost income and expenses caused by a cyberattack, and cover legal defense costs and damages awarded if it results in damages to third parties, such as customers or partners.

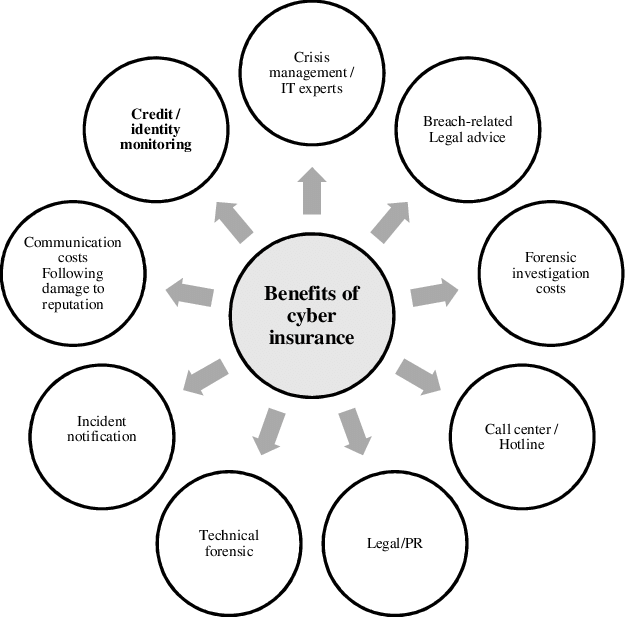

Benefits of Cyber Insurance

There are several benefits of having cyber insurance for businesses, which include:

- Protecting against financial losses – Cyber insurance can help businesses recover from financial losses caused by cybercrime activities like data breaches and cyberattacks.

- Providing peace of mind – With cyber insurance, businesses can be assured that they are protected against cyber threats, which can provide peace of mind for business owners and managers.

- Legal protection – Cyber insurance can provide legal protection for businesses that may face legal liabilities in the event of a data breach or cyberattack.

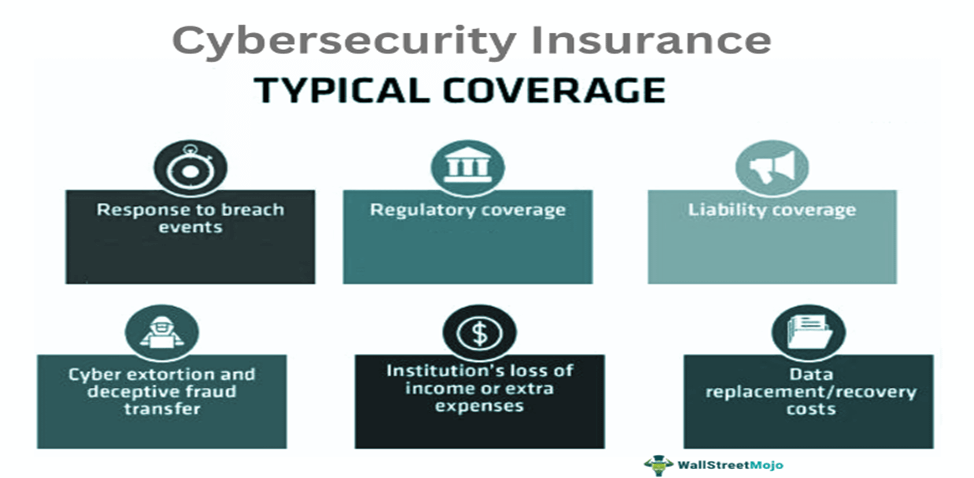

Kinds of Coverage

There are two kinds of cyber insurance coverage, which include:

- First-party cover – This coverage shields the business from costs incurred when it is afflicted by fraudulent activities such as a data breach.

- Third-party cover – This coverage offers protection from legal liabilities arising from any third party in the event of suing of the organisation for data breach and mishandling their data.

What is Not Covered?

Although cyber insurance can protect businesses from cyber threats, it is essential to note that there are certain things that cyber insurance does not cover. These include:

- Violation of contracts, breach of trade secrets and trademarks, and disputes over registered patents or intellectual property.

- Deceitful or deliberate behavior or any fraudulent act infringing the rule or regulation.

- Property damage, harm, or injuries caused due to negligence, lack of precaution to safeguard confidential banking information, etc.

- Ongoing and uninsurable legal cases.

- Physical injury, death, or damage to any tangible object.

Why In News

As businesses continue to depend on digital technology to enhance their operations, they become more susceptible to cyber threats. Cyber insurance is becoming increasingly necessary to protect businesses from the financial and reputational damage that could result from cyberattacks and data breaches.

MCQs about Benefits of Cyber Insurance for Businesses

-

What is cyber insurance?

A. An insurance product that mitigates the risk of physical damage to business assets

B. An insurance product that protects businesses from internet-based threats affecting IT infrastructure, information governance, and information policy

C. An insurance product that covers legal liabilities arising from any third party in the event of suing of the organisation for data breach and mishandling their data

D. An insurance product that provides legal protection for businesses that may face legal liabilities in the event of a data breach or cyberattack

-

What are the benefits of cyber insurance?

A. Protecting against physical damage to business assets

B. Legal protection against third-party lawsuits

C. Covering the loss resulting from a data breach

D. All of the above

-

What is not covered by cyber insurance?

A. Violation of contracts and trade secrets

B. Physical injury, death, or damage to any tangible object

C. Legal defense costs and damages awarded if it results in damages to third parties

D. None of the above

-

What are the kinds of cyber insurance coverage?

A. First-party cover and third-party cover

B. Property damage cover and legal liability cover

C. Fire damage cover and water damage cover

D. Business interruption cover and cyber liability cover

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()