The Investment Facilitation Agreement (IFA) is a proposed agreement being discussed among the members of the World Trade Organization (WTO). It aims to promote and facilitate investment by creating a more transparent, predictable, and streamlined environment for investors. However, India is apprehensive about joining the IFA negotiations and fears investor-state dispute settlement (ISDS) claims.

What is the Investment Facilitation Agreement (IFA)?

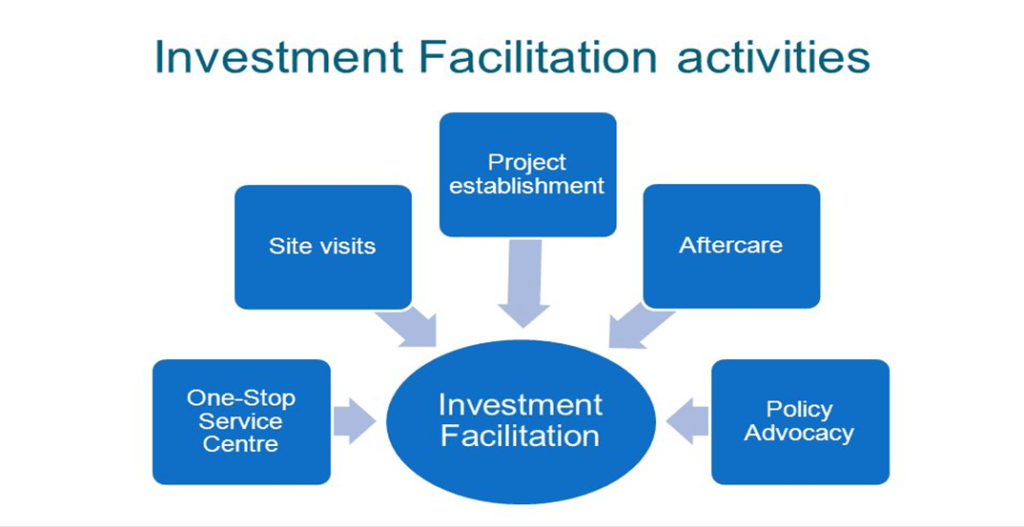

The IFA aims to improve investment facilitation by establishing guidelines for streamlined and transparent investment procedures. The agreement could help reduce investment costs and risks, enhance market access, and promote regulatory cooperation and coherence. It is intended to support investment in developing countries, particularly in sectors such as infrastructure, energy, and technology. The negotiations have involved various stakeholders, including governments, international organizations, civil society groups, and the private sector.

What is Investor-State Dispute Settlement (ISDS)?

The investor-state dispute settlement (ISDS) is a mechanism that allows investors to bring claims against states before an international tribunal. The claims are usually based on alleged violations of investment treaties, such as expropriation without compensation or discrimination. The ISDS mechanism has been a controversial aspect of Bilateral Investment Treaties (BITs) because some argue that it gives investors too much power to challenge state policies and regulations.

Arguments for India Joining the Investment Facilitation Agreement (IFA)

Boost in Foreign Investment: India has been receiving significant foreign investment inflows in recent years. Joining the IFA would help India attract more foreign investment by creating a transparent and predictable environment for investors.

Promoting Investment in Developing Sectors: The IFA aims to promote investment in developing sectors such as infrastructure, energy, and technology. Joining the agreement would provide India with opportunities to attract investment in these sectors, which are crucial for the country’s development.

Streamlined Investment Procedures: The IFA aims to streamline investment procedures by simplifying and expediting administrative processes. Joining the agreement would help India attract more investment by reducing bureaucratic hurdles for investors.

Level Playing Field: The IFA aims to create a level playing field for investors, regardless of their origin. Joining the agreement would provide India with an opportunity to ensure that its investors are treated fairly in other countries, while also ensuring that foreign investors in India are treated equally.

Resolution of Investment Disputes: The IFA addresses the issue of the investor-state dispute settlement (ISDS) mechanism, which has been a controversial aspect of Bilateral Investment Treaties (BITs). Joining the agreement would provide India with an opportunity to negotiate a more balanced ISDS mechanism that protects the interests of both investors and the state.

Multilateral Approach: The IFA is a proposed agreement currently being discussed among WTO members. Joining the agreement would provide India with an opportunity to participate in a multilateral approach to investment facilitation, rather than negotiating individual agreements with different countries.

Supporting WTO Rules: Joining the IFA would demonstrate India’s commitment to supporting the rules-based trading system and the multilateral trading system, which are important for promoting global economic growth and development.

India’s Fear of ISDS Claims

India’s fear of ISDS claims is one of the reasons for its non-participation in IFA negotiations. However, India should not let the fear of ISDS claims stop it from participating in the IFA negotiations at the WTO. Although the possibility of ISDS tribunals interpreting provisions broadly cannot be ruled out, it should not be a reason to oppose international lawmaking. India should take part in the IFA negotiations and strive to ensure that the agreement is fair, balanced, and meets its developmental needs while protecting its policy space.

Why In News

India has been cautious about joining the negotiations for the Investment Facilitation Agreement (IFA) due to concerns regarding investor-state dispute settlement (ISDS) claims. The fear of ISDS claims has been a major factor hindering India’s participation in the IFA negotiations.

MCQs about Benefits of the Investment Facilitation Agreement (IFA) for India

-

What is the Investment Facilitation Agreement (IFA)?

A. A proposed agreement being discussed among the members of the World Trade Organization (WTO)

B. An agreement between India and the United States to promote investment

C. An agreement to restrict investment in developing countries

D. None of the above

-

What is the aim of the IFA?

A. To promote and facilitate investment

B. To restrict investment

C. To impose tariffs on foreign investment

D. None of the above

-

What is the fear of investor-state dispute settlement (ISDS)?

A. Countries may use the IFA to undermine existing investment protection measures

B. The IFA could lead to increased investment costs and risks

C. The IFA could lead to reduced market access

D. None of the above

-

What are some arguments for India joining the IFA?

A. Boost in Foreign Investment

B. Promoting Investment in Developing Sectors

C. Streamlined Investment Procedures

D. All of the above

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()