Carbon Border Adjustment Tax (CBAT), also known as the Carbon Border Adjustment Mechanism (CBAM), is a policy proposed by the European Union (EU) to tax products that are extremely carbon-intensive. CBAT would be levied on imports based on the amount of carbon emissions resulting from the production of the product in question. The EU plans to implement this policy in 2026.

The Significance of CBAT

Discouraging Emissions: CBAT discourages emissions by acting as a price on carbon. As a trade-related measure, it affects production and exports. The EU is concerned with the relocation of production to countries with less ambitious climate policies, which undermines both the EU’s and global climate objectives.

Promoting Fair Competition: The CBAT aims to promote fair competition by equalizing the price of carbon between domestic products and imports. It levels the playing field between EU and non-EU businesses.

How CBAT Works

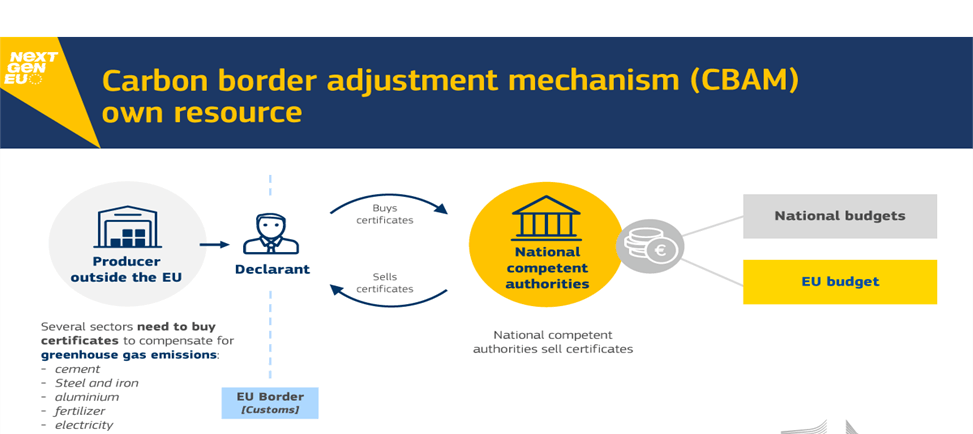

If implemented as planned, EU importers will have to buy carbon certificates corresponding to the carbon price that would have been paid in the EU if the goods had been produced locally. The price of the certificates would be calculated according to the auction prices in the EU carbon credit market. The amount of certificates required would be defined yearly by the quantity of goods and the embedded emissions in those goods imported into the EU.

Initially, the CBAT would apply to imports of cement, iron and steel, aluminium, fertilizers, and electricity. The UK also proposes levying CBAT on a range of products, including cement, chemicals, glass, iron and steel, non-ferrous metals, non-metallic minerals, paper and pulp, fertiliser, and power generation. The list will gradually expand to cover all products by 2034.

Opponents of CBAT

BASIC Group: BASIC, a group constituting Brazil, India, South Africa, and China, which are large economies dependent on coal, has voiced common concerns and reiterated their right to use fossil fuel in the interim during their countries’ eventual transformation to clean energy sources. At COP27, the BASIC group opposed the carbon border tax, stating that it could result in market distortion and aggravate the trust deficit among parties.

Experts’ Concerns: According to some experts, CBAT is unjust and may not help in reducing pollution as there is no focus on lowering wasteful consumption.

Preparing for CBAT’s Impact

Minimizing Impact: CBAT will affect many small and large firms. Indian exporters must factor CBAT into their costing and prepare to minimize its impact.

Focusing on Greener Production Options: The rate of CBAT depends on how much carbon has been emitted during production to make the export product. Therefore, there is a need to explore greener production options for the concerned commodities. For example, steel made from a blast furnace route emits more carbon dioxide and may attract a higher tax than steel made through an electric arc furnace or steel made using green hydrogen.

Sharing Emission Data: Indian exporters of steel, aluminium, cement, fertiliser, hydrogen, and electricity will need to share precise emission data with the counterpart EU importers, who will share the data with the CBAT authorities. Scientifically capturing this data will need the help of energy auditors.

Using Power Generated from Renewable Energy: This will immediately lower the carbon load. Fossil fuels like coal, oil, or natural gas cause 75% of global carbon dioxide emissions. Wind, solar, and green hydrogen are current options. However, switching to new technology is expensive and may only be feasible in some cases.

Why In News

Several major economies, including the EU, UK, Canada, Japan, and the US, are currently preparing to implement a Carbon Border Adjustment Tax (CBAT) on imports in order to discourage carbon emissions and promote fair competition.

MCQs about Carbon Border Adjustment Tax

-

What does CBT stand for in the context of international trade?

A. Cross-Border Taxation

B. Corporate Business Tax

C. Controlled Border Tariff

D. Customs Barrier Trade

-

Which of the following countries is not mentioned in the essay as planning to levy CBT?

A. China

B. Canada

C. Japan

D. Germany

-

What is the purpose of levying CBT on imports?

A. To increase the volume of imports

B. To protect domestic industries from foreign competition

C. To reduce the cost of imported goods

D. To promote free trade

-

Which of the following statements about CBT is true?

A. CBT is levied by exporting countries

B. CBT is a type of tariff

C. CBT is only levied on luxury goods

D. CBT does not affect international trade

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()