In recent years, debt-for-climate swaps have gained popularity among low- and middle-income countries as a way to reduce their debt obligations while committing to finance domestic climate projects. The concept was introduced as a debt restructuring device aimed at combatting climate change by ensuring that debt-ridden countries can address climate change locally without incurring additional debt.

The Idea Behind Debt Swaps

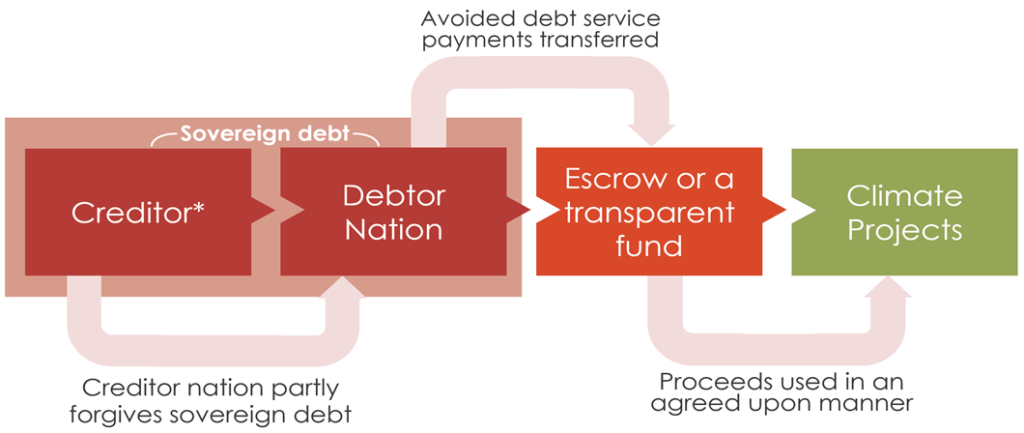

Debt swaps have dual objectives – to promote specific investment and policy action, while also providing some debt relief. The logic underlying the concept is the acquisition of debt with some concession. For example, a debt-for-climate swap is an agreement between the creditor and a debtor in which the creditor forgives a portion of the debtor’s foreign debt or provides debt relief in return for a commitment by the government to invest in a specific environmental project.

How Debt-for-Climate Swaps Work

To implement a debt-for-climate swap, a new agreement is worked out with a multilateral or bilateral partner to replace the terms of the initial loan agreement. The remaining debt is then directed towards “green or blue” domestic investments on mutually agreed terms. Green investments focus on projects or areas committed to preserving the environment, while blue investments focus on sustainable use of ocean resources.

Why Debt-for-Climate Swaps Are Attractive

There are several reasons why debt-for-climate swaps are attractive to both creditors and debtors.

Fulfillment of Commitments Under Various Agreements

For signatories to the Paris Agreement and the Glasgow Financial Alliance for Net Zero (GFANZ), debt-for-climate swaps are one way to fulfill their commitments to provide financial assistance to developing countries to build clean, climate-resilient futures.

Transparency

Debt-for-climate swaps are attractive due to their transparency. The concessional capital is assured to be directed to climate projects, with third-party guarantors overseeing the escrow fund. Transparency is key to ensuring commitment.

Investments in Island Countries

Debt-for-climate swaps offer an innovative way to make climate investments in climate-vulnerable island developing economies while creating the much-needed fiscal space. They also support climate investment by committing a country to shift their spending from debt service to an agreed public investment.

Important Points:

🌍 Debt-for-climate swaps: Countries can reduce debt obligations in exchange for financing domestic climate projects.

👥 Dual objectives: Debt swaps aim to promote specific investment and policy action while also providing debt relief.

💰 How it works: A new agreement is worked out with a multilateral or bilateral partner to replace the terms of the initial loan agreement and direct the remaining debt towards “green or blue” domestic investments.

👍 Attractive features: Debt-for-climate swaps are attractive due to their transparency, assurance that capital is directed to climate projects, and innovative way to make climate investments in climate-vulnerable island developing economies.

💸 Benefits for small developing countries: Debt-for-climate swaps create much-needed fiscal space without causing policy disruptions, but scaling up the debt swap is still much lower than grants.

🤝 Responsibility of rich countries: Rich countries have a responsibility to support poorer nations by dispensing debt to Global South countries due to the Global North’s climate debt from disproportionately higher emissions.

Why In News

In the past decade, as the urgency to address climate change has grown, debt-for-climate swaps have become increasingly popular among low- and middle-income countries as a means to alleviate their debt burdens while financing domestic climate projects.

MCQs about Debt-for-Climate Swaps

-

What is the main objective of debt-for-climate swaps?

A. To reduce debt obligations and finance domestic climate projects

B. To increase debt obligations and finance domestic climate projects

C. To reduce debt obligations without investing in climate projects

D. To increase debt obligations without investing in climate projects

-

Why are debt-for-climate swaps attractive to signatories of the Paris Agreement and the Glasgow Financial Alliance for Net Zero (GFANZ)?

A. To fulfil financial commitments to developing countries for building clean, climate-resilient futures

B. To ignore financial commitments to developing countries for building clean, climate-resilient futures

C. To fulfil financial commitments to developed countries for building clean, climate-resilient futures

D. To ignore financial commitments to developed countries for building clean, climate-resilient futures

-

Which type of investments do “blue” investments focus on?

A. Projects or areas committed to preserving the environment

B. Sustainable use of ocean resources

C. Renewable energy projects

D. Carbon capture and storage projects

-

What is a potential obstacle to scaling up the use of debt-for-climate swaps?

A. Lack of transparency

B. Inability to create fiscal space

C. Creditors’ reluctance to see their gain in the deal

D. Lack of commitment from developing countries

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()