Daily Current Affairs : 11-August-2023

In a world grappling with rising inflation, China has taken a surprising turn. For the first time in over two years, consumer prices in China have experienced a decline. This phenomenon, known as deflation, stands in stark contrast to the global trend of inflation. Deflation, a term referring to a general decrease in prices of goods and services, has far-reaching implications for an economy’s health and growth prospects. Let’s delve into the concept of deflation, its implications, and China’s unique situation.

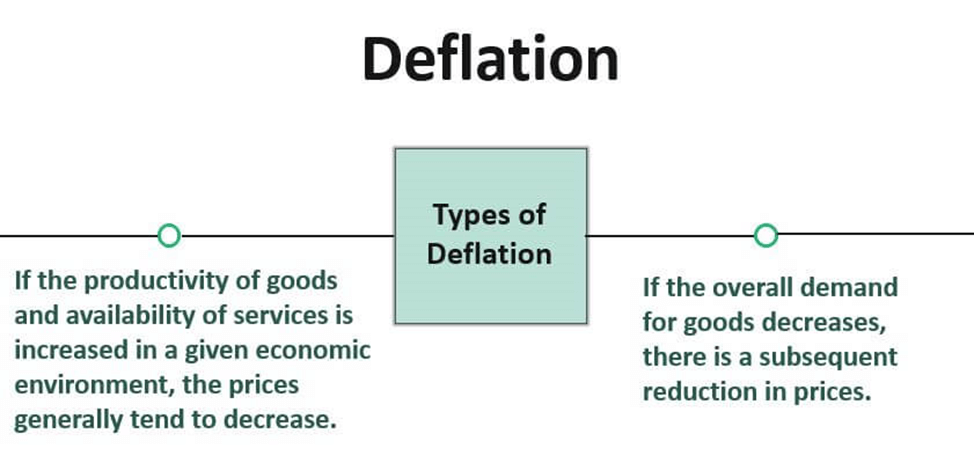

Understanding Deflation

Deflation, often juxtaposed with inflation, involves a downward spiral of prices. In the past, the terms “inflation” and “deflation” referred to the increase or decrease in the money supply, rather than price fluctuations. An increase in the money supply was thought to fuel price hikes, while a decrease was believed to lead to price drops.

Concerns Arising from Deflation

- Economic Slowdown: Deflation is a red flag for falling demand, potentially triggering an economic slowdown. Demand for goods and services is the driving force behind economic growth.

- Postponed Purchases: Falling prices might tempt consumers to delay purchases, expecting further price drops. However, this can dampen demand and hinder economic activity.

- Business Struggles: While some inflation can be beneficial for optimal resource utilization, deflation can hurt businesses by stagnating growth and causing losses due to sticky costs.

- Credit Contract Issues: Deflation can disrupt credit contracts, making borrowers repay lenders more in real terms.

When Deflation Isn’t Worrisome

- Rapid Economic Growth: Some economies, like the U.S. and China, have experienced deflation during robust economic growth periods. Japan, despite its prolonged deflation, witnessed per capita income rise during this phase.

- Supply Surge: Deflation can arise from an abundance of goods and services outpacing money supply growth.

- Temporary Phenomenon: During crises, cautious spending can lead to temporary drops in individual expenditures.

- Resource Reallocation: Deflation might signal a resource reallocation process, impacting spending on different goods in varying ways.

- Consumer Demand vs. Prices: Consumer demand influences prices more than prices affect demand. The causal link runs from demand to prices, not vice versa.

- Business Adaptation: Businesses can adjust input costs based on what consumers are willing to pay, potentially avoiding sustained losses.

Decoding China’s Deflation

China’s deflationary episode carries unique features:

- Central Bank Policy: China’s central bank maintains low interest rates to stimulate demand, unlike other central banks addressing post-pandemic inflation.

- Root Cause: The cause behind China’s deflation might be more fundamental than mere liquidity shortages. Turmoil in the property sector, a significant contributor to GDP, has predated the pandemic.

- Economic Soft Landing: China aims for a controlled slowdown of its economy amidst property sector turmoil and credit booms, which can lead to misallocation of resources and broader price declines.

Important Points:

Deflation Basics:

- Deflation signifies a general decrease in prices of goods and services in an economy.

- Historically, “inflation” and “deflation” referred to changes in money supply, not prices.

- Rising money supply was thought to cause inflation, while falling supply led to deflation.

Concerns Arising from Deflation:

- Economic slowdown results from reduced demand for goods and services.

- Falling prices might prompt consumers to delay purchases, dampening demand.

- Businesses struggle due to stagnant growth and losses from fixed costs.

- Deflation disrupts credit contracts, making borrowers repay lenders more in real terms.

When Deflation Isn’t a Concern:

- Some economies experience deflation during periods of rapid economic growth.

- Deflation can stem from an oversupply of goods and services surpassing money supply growth.

- Temporary deflation might occur during economic crises as cautious spending prevails.

- Resource reallocation can lead to shifts in spending on different goods.

- Consumer demand primarily influences prices, rather than the other way around.

- Businesses can adapt to deflation by adjusting input costs to consumer willingness.

China’s Unique Deflation Situation:

- China experiences deflation while its central bank maintains low interest rates to boost demand.

- Unlike other countries addressing post-pandemic inflation, China’s issue seems more fundamental.

- Turmoil in the property sector, a significant GDP contributor, predates the pandemic.

- China aims for a controlled economic slowdown amidst property sector challenges and credit booms.

Why In News

In July, China witnessed its first decline in consumer prices in over two years, painting a distinct economic picture compared to the global scenario. While the rest of the world continues to grapple with surging inflation as its primary concern, China’s deflationary trend marks a unique divergence in current economic trends.

MCQs about Decoding Deflation

-

What does deflation refer to in an economy?

A. A general increase in prices of goods and services.

B. A decrease in the money supply.

C. A general fall in the prices of goods and services.

D. An increase in the money supply.

-

When can deflation be a temporary phenomenon?

A. During times of rapid economic growth.

B. When there is an oversupply of goods.

C. When credit contracts are disrupted.

D. When consumer demand determines prices.

-

Why is China experiencing deflation despite maintaining low interest rates?

A. Lack of liquidity in the economy.

B. Property sector turmoil and economic challenges.

C. Global trends of inflation.

D. Overstimulation of consumer demand.

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()