Investing in companies that prioritize environmental, social, and governance (ESG) standards and contribute to sustainable development goals has become increasingly popular in recent years. However, it is important to understand the distinction between ESG investing and impact investing to allocate funds efficiently towards these goals. This article explores the differences between these two investment approaches, their importance, and the need to understand these differences for efficient capital allocation.

ESG Investing vs. Impact Investing

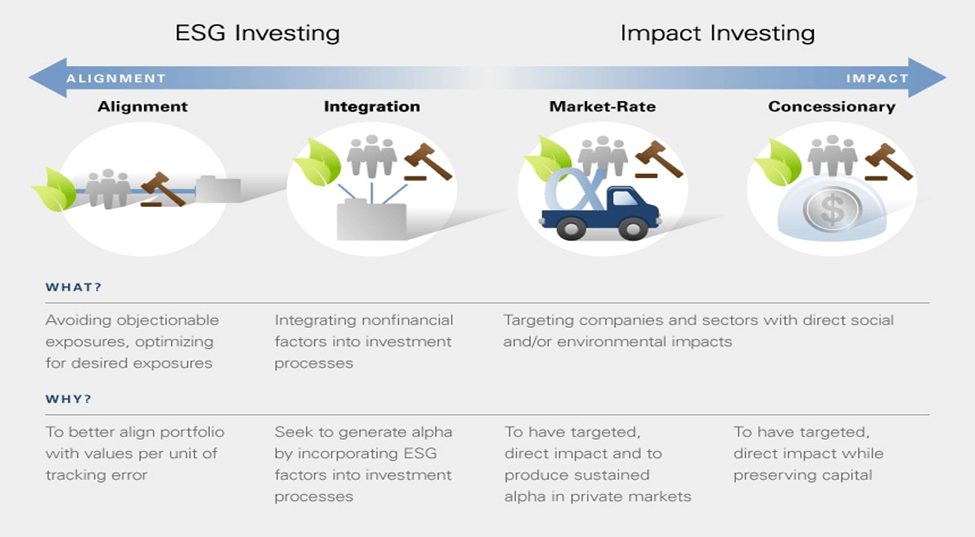

- ESG investing involves investing in companies that meet ethical considerations of environmental, social, and governance standards.

- The focus is on avoiding investments in companies that harm the environment or engage in unethical business practices.

- Impact investing aims to create a positive social or environmental impact alongside financial returns.

- It involves investing in companies that actively work toward creating positive social or environmental change.

- Impact investing is a subset of ESG investing, but not all ESG investments can be considered impact investments.

- All impact investments comply with ESG standards.

- ESG investing typically focuses on a company’s past performance and whether it meets ESG standards.

- Impact investing focuses on a company’s plans to create a positive impact in the future.

- Due diligence in ESG investing typically focuses on a company’s business practices and internal policies and procedures.

- Impact due diligence includes extensive data and assessment of the impact outcomes of a company’s actions and products.

- For example, ESG investing might involve investing in a company that has a strong track record of reducing its carbon emissions and has policies in place to promote diversity and inclusion.

- Impact investing might involve investing in a company that develops renewable energy technology or provides access to healthcare in underserved communities.

Importance of Understanding the Differences

Understanding the differences between ESG investing and impact investing is crucial for investors to allocate capital efficiently, align their investment goals, and contribute towards achieving the UN’s Sustainable Development Goals.

Efficient Allocation of Capital: By understanding the differences between the two investment approaches, investors can allocate their capital more efficiently towards their investment goals.

Transparency and Clarity: Clear understanding of the differences can bring more transparency and clarity to the investment industry, preventing activities like greenwashing and ensuring that funds are deployed effectively.

Alignment with Investment Goals: Understanding the differences between ESG investing and impact investing can help investors align their investment goals with the appropriate approach, thereby maximizing their impact.

Contribution towards Sustainable Development Goals: Impact investing is more directly linked to contributing towards sustainable development goals, and understanding the differences between ESG and impact investing can help investors channel their funds towards achieving these goals.

Improved Due Diligence: By understanding the differences, investors can conduct more comprehensive due diligence on the companies they are investing in, especially in the case of impact investing, which requires additional assessment of the impact outcomes of a company’s actions.

Why In News

It is essential to understand the difference between ESG investing and impact investing to allocate funds efficiently towards sustainable development goals. By having a clear understanding of the distinction, investors can align their investment goals with the appropriate approach, thereby maximizing their impact and contributing towards achieving the UN’s Sustainable Development Goals.

MCQs about ESG vs. Impact Investing

-

Which of the following statements is true about ESG investing?

A. It involves investing in companies that meet environmental, social, and governance standards.

B. It involves investing in companies that create a positive social or environmental impact alongside financial returns.

C. It involves investing in companies that engage in unethical business practices.

D. It involves investing in companies that have a weak track record of reducing their carbon emissions.

-

Which of the following statements is true about impact investing?

A. It involves investing in companies that meet environmental, social, and governance standards.

B. It involves investing in companies that create a positive social or environmental impact alongside financial returns.

C. It involves investing in companies that engage in unethical business practices.

D. It involves investing in companies that have a weak track record of reducing their carbon emissions.

-

What is the difference between ESG investing and impact investing?

A. All impact investments comply with ESG standards, but not all ESG investments can be considered impact investments.

B. ESG investing typically focuses on a company’s plans to create a positive impact in the future, while impact investing focuses on a company’s past performance.

C. Due diligence in ESG investing typically includes extensive data and assessment of the impact outcomes of a company’s actions and products, while impact due diligence focuses on a company’s business practices and internal policies and procedures.

D. All of the above.

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()