The financial technology or fintech sector in India is undergoing a rapid evolution, presenting both challenges and opportunities. This article explores the topic from the perspective of the IAS exam, specifically focusing on the economy segment of GS paper III.

Contrasts in the Banking System:

India’s banking system presents a stark contrast. While it boasts one of the highest numbers of bank accounts globally, the per capita account balance remains significantly low. This metric reflects the developing nature of the Indian economy.

Rural-Urban Divide:

The divide between rural and urban areas is evident in deposit patterns. The rural population, which constitutes around 60% of the country’s total, contributes to less than 10% of the deposits. In contrast, the urban population, comprising only around 12% of the country’s total, contributes to 50-60% of the deposits.

Strengths of Indian Financial Institutions:

Despite these disparities, Indian financial institutions are among the best globally in certain aspects. Non-performing assets (NPAs) are low, accounting for only 3-5% of total assets. Moreover, the capital adequacy ratio is high at 18%, and the return on equity stands at an impressive 15%.

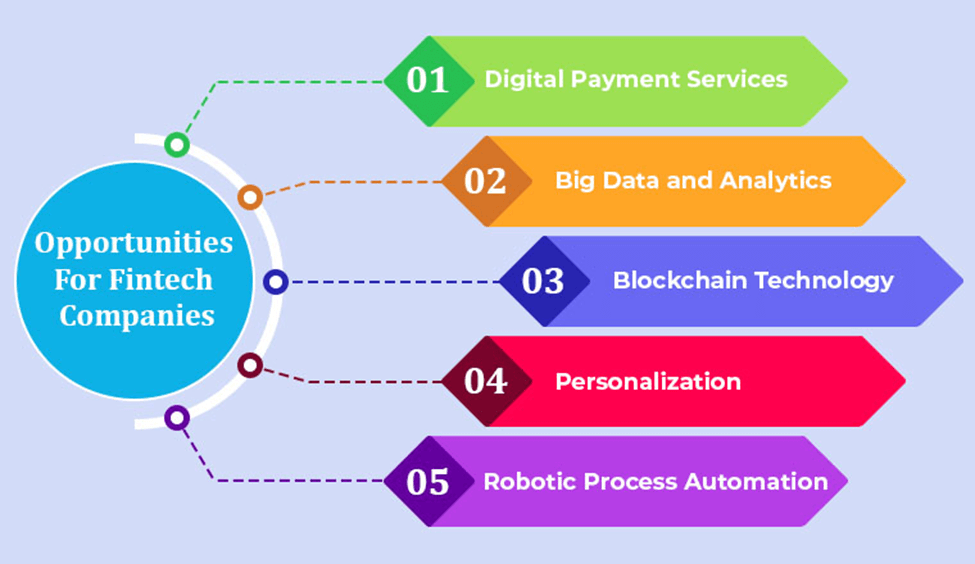

Opportunities for the Fintech Sector:

Foundation of Financial Sector: India’s financial sector benefits from a strong foundation, with world-class infrastructure, well-regulated bodies, and a robust capital market framework. These elements provide a conducive environment for fintech growth and innovation.

Initiatives and Innovations:

The financial sector landscape in India is continuously progressing through various initiatives and innovations. Key examples include Jan Dhan, Aadhar, UPI, differentiated banking/insurance licenses, Central Bank Digital Currency (CBDC), Account Aggregator, the Open Credit Enablement Network (OCEN), Digilocker, and the Open Network for Digital Commerce (ONDC). These initiatives aim to enhance financial inclusion and efficiency.

Market Potential:

The current financial services market cap in India stands at $850 billion and is projected to reach $1.7 trillion by 2030. With the economy also poised to become a $5 trillion economy by then, the fintech sector has ample opportunities for growth.

Access, Efficiency, and Customer Experience:

Three critical opportunities have emerged for the fintech sector in India: access, efficiency, and the demand for superior customer experiences.

- Access: India’s unique demographic profile, characterized by a large young population and low financial penetration, presents significant opportunities for innovation in reaching underserved populations.

- Efficiency: The fintech sector can leverage its globally competent products, skilled labor, talent, and world-class infrastructure to drive efficiency and streamline financial services.

- Customer Experience: By providing differentiated and superior products and services, fintech companies can meet the growing demand for enhanced customer experiences. This includes user-friendly interfaces, personalized services, and quick and seamless transactions.

Important Points:

- Contrasts in the Indian banking system 🏦:

- High number of bank accounts globally 🌍

- Low per capita account balance 💰

- Rural-urban divide in deposits 🌆🏞️

- Strengths of Indian financial institutions 🌟:

- Low non-performing assets (NPAs) 📉

- High capital adequacy ratio 💪

- High return on equity 📈

- Opportunities for the Fintech Sector 🚀:

- Strong foundation of financial sector infrastructure 🏢

- Initiatives and innovations driving progress:

- Jan Dhan, Aadhar, UPI, differentiated licenses 🆔💳

- Central Bank Digital Currency (CBDC) 💱

- Account Aggregator, OCEN, Digilocker, ONDC 📱💼🔐

- Market potential:

- Current financial services market cap: $850 billion 💲

- Projected market cap by 2030: $1.7 trillion 💹

- Goal of a $5 trillion economy by 2030 📈💼

- Three important opportunities for fintech sector:

- Access:

- Unique demography with high young population 🌍👥

- Low financial penetration 🚀

- Efficiency:

- Globally competent products and skilled labor 👩💼🌎

- World-class infrastructure 🌐

- Customer experience:

- Demand for superior products and services 🌟👥

- User-friendly interfaces and seamless transactions 💻💫

- Access:

Why In News

The financial technology or fintech sector in India is experiencing a remarkable transformation, characterized by its rapid evolution and technological advancements. However, amidst this progress, it also highlights the stark contrasts that exist within the country’s banking system, showcasing both the innovative potential and persistent challenges faced by various stakeholders.

MCQs about India’s Fintech Sector

-

What is one of the key contrasts in India’s banking system ?

A. High per capita account balance

B. Equal contribution to deposits from rural and urban populations

C. Low non-performing assets (NPAs)

D. Rural-urban divide in deposits

-

What are three important opportunities for the fintech sector in India?

A. Access, efficiency, and demand for inferior customer experience

B. Access, affordability, and reduced regulatory framework

C. Access, efficiency, and demand for superior customer experience

D. Access, availability, and digitalization of physical branches

-

Which initiatives and innovations are driving progress in India’s financial sector?

A. Cashless transactions, retail banking, and paperless documentation

B. Cryptocurrency, virtual reality, and online shopping

C. Jan Dhan, Aadhar, UPI, and Central Bank Digital Currency (CBDC)

D. Automated teller machines (ATMs), credit cards, and mobile banking

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()