The Indian government recently announced that it will expand the definition of “political risk” under the export guarantee scheme to cover any fresh imposition of non-tariff barriers by importing nations after a shipment has left Indian shores. This move aims to provide more comprehensive protection to Indian exporters. In this essay, we will discuss the key details and implications of this policy change.

Background on Export Credit Guarantee Corporation (ECGC)

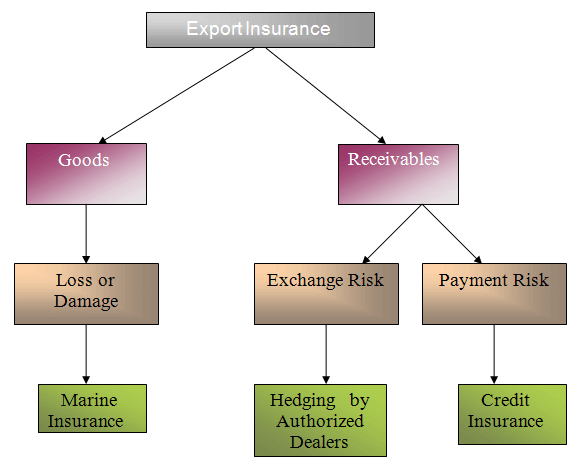

The Export Credit Guarantee Corporation (ECGC) is a government-owned company that was established in 1957 with the primary aim of promoting exports from India by providing credit risk insurance and related services. ECGC provides a range of insurance covers to Indian exporters against the risk of non-realization of export proceeds due to commercial or political risks. The organization also provides different types of credit insurance covers to banks and other financial institutions to enable them to extend credit facilities to exporters.

Expanding the Definition of Political Risk

Under the current scheme, the ECGC indemnifies exporters for losses when buyers turn insolvent or default on payments, political risks like war, and sudden import restrictions or promulgations of laws or decrees.

However, the scheme does not cover anti-dumping steps or non-tariff barriers. This policy change will include some of the anti-dumping measures or non-tariff barriers introduced after a shipment has been made under the purview of the political risk.

The inclusion of anti-dumping measures and non-tariff barriers as political risks will provide exporters with comprehensive protection against potential losses caused by these measures. The move will be beneficial for small and medium enterprises (SMEs) in particular, which may not have the resources to navigate the complex regulatory landscape of foreign markets.

Inter-Ministerial Committee for MSME Trade-Related Grievances

The policy change also promises to set up an inter-ministerial committee to examine MSME trade-related grievances that have policy ramifications. This committee will adopt a “whole-of-government” approach to expedite decision-making. This move aims to address the longstanding complaint of Indian SMEs that the government’s response to their grievances has been slow and inadequate.

Doing Away with Mandatory Re-Export

Another significant change under the new policy is the removal of a requirement for importers who store their merchandise in bonded warehouses to re-export such goods if they were not cleared for domestic consumption within one year. The clearance of the warehoused goods shall be as per the provisions of the Customs Act, 1962, which does not have an expiry date.

This policy change will provide relief to importers, especially those dealing with time-sensitive goods such as perishables or seasonal items, who may face significant losses due to re-export requirements.

Why In News

The definition of “political risk” under the export guarantee scheme is a significant move by the Indian government to provide more comprehensive coverage to exporters. This change will help Indian exporters mitigate the risks associated with non-tariff barriers and anti-dumping measures introduced by importing countries.

MCQs about Export Credit Guarantee Corporation in India

-

The Export Credit Guarantee Corporation (ECGC) indemnifies exporters for all of the following except:

A. Losses when buyers turn insolvent or default on payments

B. Political risks like war

C. Sudden import restrictions or promulgations of laws or decrees

D. Anti-dumping measures and non-tariff barriers

-

What is the purpose of the new policy introduced by the government?

A. To expand the definition of “political risk”

B. To set up an inter-ministerial committee to examine MSMEs’ trade-related grievances

C. To mandate re-export of merchandise stored in bonded warehouses

D. To improve the competitiveness of Indian exports by providing them with credit insurance covers

-

What is the aim of the Export Credit Guarantee Corporation (ECGC)?

A. To promote imports into the country

B. To provide credit risk insurance and related services for imports

C. To improve the competitiveness of Indian exports by providing them with credit insurance covers

D. To administer the National Import Insurance Account (NIIA) Trust

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()