The Cabinet Committee on Economic Affairs has recently approved a new gas pricing mechanism that links domestic natural gas prices to global crude prices. The new reforms are based on the recommendations of the Kirit Parikh panel and aim to address the time lag and volatility issues present in the previous pricing mechanism. In this article, we will discuss the details of this move, how it will impact gas prices in India

Current Gas Pricing Mechanism

The current gas pricing mechanism is based on the domestic gas pricing guidelines approved in 2014. Under this mechanism, the domestic gas price is set for a period of six months based on volume-weighted prices prevailing in four gas trading hubs for a period of 12 months. These four gas trading hubs are Henry Hub, Albena, National Balancing Point (UK), and Russia.

Reason for the Recent Reforms

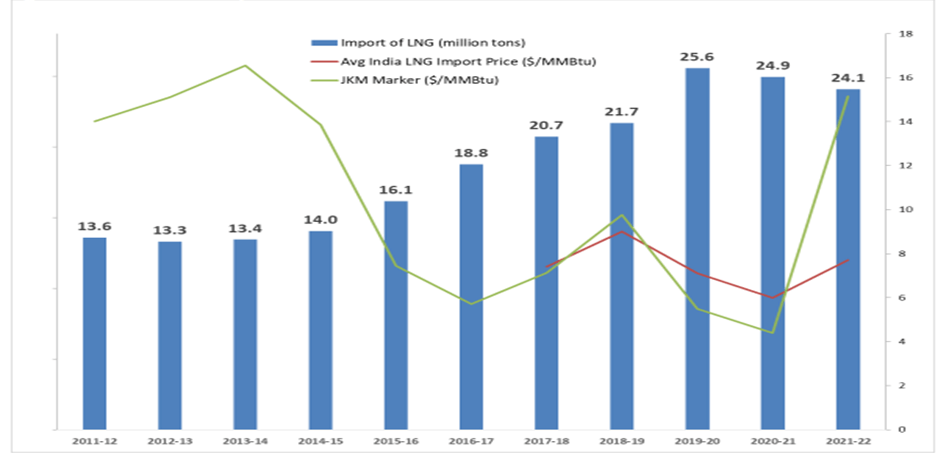

The previous gas pricing mechanism had significant time lag and high volatility, which resulted in a surge in international gas prices over the last few years, causing an increase in gas prices in India. This increase in gas prices has led to a higher burden of fertilizer subsidies.

Gas Pricing Mechanism Changes

The reforms introduced in the new gas pricing mechanism are based on the recommendations of the Kirit Parikh panel. The government has accepted some recommendations and rejected others.

Accepted Recommendations:

- Benchmarking of APM gas price to crude oil price

- Introducing floor as well as ceiling prices

- Providing a 20% premium for gas from new wells

- Leaving the pricing system for gas from difficult fields unchanged

Recommendations Not Accepted:

- Hiking the ceiling every year

- Raising the ceiling by 50 cents per year

- Deregulation of APM gas prices

The APM gas price will be recalculated on a monthly basis and will be equivalent to 10% of the average price of the Indian crude basket in the preceding month. The Indian crude basket represents a derived basket that includes both sour and sweet crude oil grades in a proportion of 75.62 to 24.38, reflecting the blend of crude grades utilized by Indian refineries.

Gas produced from legacy or nomination fields will have a floor price of $4 and a ceiling price of $6.5 per million British thermal units (mBtu). Natural gas production from these fields accounts for about 2/3rd of India’s total natural gas production. The pricing regime followed on the domestic natural gas produced from these areas mainly came under administered price mechanism (APM).

Impact of Linking Local Gas Prices to Global Crude Benchmarks

The new pricing system aims to incentivize ONGC and OIL to increase production from their legacy fields by offering them a premium of 20% over the APM price for gas extracted from new wells and for implementing technology enhancements in existing wells.

The linking of local gas prices to global crude benchmarks will protect customers from high prices while ensuring that producers do not face losses. The government anticipates that the implementation of the new pricing mechanism will lead to a considerable reduction in retail prices for compressed natural gas (CNG) used as fuel for automobiles and piped natural gas (PNG) for households. It is also expected to aid gas-based power generation units and lower the government’s fertilizer subsidy burden.

Why In News

The Indian government recently approved a significant reform in the domestic gas pricing mechanism, which involves linking domestic natural gas prices to global crude prices. This move aims to bring transparency and stability in gas pricing while aligning it with global practices.

MCQs about Gas Pricing Reforms in India

-

What is the current gas pricing mechanism in India based on?

A. Domestic gas pricing guidelines approved in 2014

B. Kirit Parikh panel recommendations

C. Rangarajan committee recommendations

D. None of the above

-

What is the aim of the new gas pricing mechanism approved by the Cabinet Committee on Economic Affairs?

A. To link domestic natural gas prices to global crude prices

B. To increase gas prices in India

C. To provide a 20% premium for gas from legacy fields

D. None of the above

-

Which of the following is not a recommended change in the new gas pricing mechanism?

A. Benchmarking of APM gas price to crude oil price

B. Introducing floor as well as ceiling prices

C. Deregulation of APM gas prices

D. Hiking the ceiling price every year

-

What is the impact of linking local gas prices to global crude benchmarks?

A. Protects customers from high prices while ensuring producers don’t face losses

B. Leads to a considerable increase in retail prices for compressed natural gas (CNG)

C. Increases the government’s fertilizer subsidy burden

D. None of the above

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()