Daily Current Affairs : 9-January-2024

The recently released First Advance Estimates (FAEs) by the Government of India predict a 7.3% GDP growth for the ongoing financial year, surpassing the previous year’s 7.2%. This provides an optimistic outlook for India’s economic trajectory, crucial for understanding the nation’s economic landscape.

Release Timeline

The FAE is unveiled in early January annually, offering initial growth estimates. Subsequent releases include the Second Advance Estimates in February, Provisional Estimates in May, and Revised Estimates over the next three years before the final “Actuals” are determined.

Significance of FAEs

FAEs are critical as they are the last GDP data before the Union Budget, shaping budgetary numbers. In 2024, these estimates gain additional importance due to the upcoming Lok Sabha elections, influencing economic considerations.

Insight into India’s Economic Performance: FAEs for 2023-24

Overview of GDP Data

Projected to reach Rs 172 lakh crore by March 2024, India’s real GDP growth has been remarkable, starting from Rs 98 lakh crore when Prime Minister Modi took office, reaching almost Rs 140 lakh crore at the beginning of his second term.

Annual Growth Rate Surprise

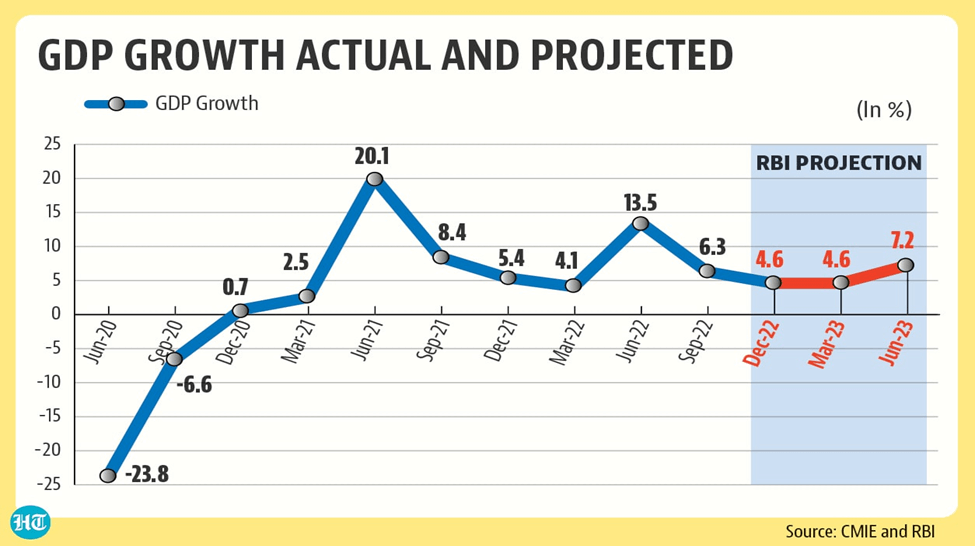

The estimated 7.3% growth rate exceeds expectations, showcasing the strength of India’s economic recovery. However, a noticeable deceleration is observed in the second term, with a compounded annual growth rate dropping from 7.4% to 4.1%.

Contributors to India’s Growth: Four Main Engines of GDP Growth

Private Final Consumption Expenditure (PFCE)

Contributes nearly 60% to GDP, but growth is muted at 4.4%, especially in rural India due to growing inequality.

Gross Fixed Capital Formation (GFCF)

Accounts for around 30%, growing by 9.3%, reflecting optimism but raising concerns about a significant portion coming from the government.

Government Final Consumption Expenditure (GFCE)

Comprises about 10% of GDP, growing at a slow rate of 3.9%, indicating weaker growth compared to private demand.

Net Exports

Despite a negative sign, indicating more imports than exports, the drag effect has increased by 144% in the current year.

Concerns and Considerations: Addressing Inequality and Government Spending

Inequality Impact on Consumption

Growing inequality contributes to muted private consumption growth, particularly in rural India.

Government Spending

Despite disruptions due to Covid, government spending has barely grown in the second term, raising concerns about its impact on economic growth.

Important Points:

- GDP Growth Outlook

- First Advance Estimates (FAEs) project a 7.3% GDP growth for 2023-24.

- Surpasses the previous year’s 7.2%, providing an optimistic economic outlook for India.

- FAEs Release Timeline

- FAEs unveiled in early January annually.

- Subsequent releases include Second Advance Estimates (February), Provisional Estimates (May), and Revised Estimates over three years.

- Significance of FAEs

- Critical as the last GDP data before the Union Budget, shaping budgetary numbers.

- Gains additional importance in 2024 due to the upcoming Lok Sabha elections, influencing economic considerations.

- Insight into India’s Economic Performance

- Projected real GDP to reach Rs 172 lakh crore by March 2024.

- Growth trajectory from Rs 98 lakh crore to almost Rs 140 lakh crore, with an annual growth rate surprise of 7.3%.

- Growth Trajectory Analysis

- Noticeable deceleration in the second term, with a compounded annual growth rate dropping from 7.4% to 4.1%.

- Initial slow growth in the first two years significantly influences overall growth trajectory.

- Contributors to India’s Growth

- Four main engines: PFCE (60% of GDP), GFCF (30%), GFCE (10%), and Net Exports.

- Private consumption demand grows by 4.4%, reflecting muted performance, especially in rural areas.

- Investment spending grows by 9.3%, raising concerns about a significant government contribution.

- Government spending grows at a slow rate of 3.9%, indicating weaker growth compared to private demand.

- Net exports show a negative sign, with the drag effect increasing by 144% in the current year.

- Concerns and Considerations

- Growing inequality impacting muted private consumption growth, particularly in rural India.

- Government spending, despite disruptions due to Covid, barely grows in the second term, raising concerns about its impact on economic growth.

Why In News

The First Advance Estimates (FAEs) from the Government of India indicate a projected GDP growth of 7.3% for the current financial year (2023-24). This growth rate, slightly surpassing the 7.2% recorded in the previous year (2022-23), offers an optimistic outlook for India’s economic trajectory, showcasing resilience and potential for continued recovery amid evolving global economic conditions.

MCQs about India’s 2023-24 Economic Outlook

-

What is the projected GDP growth for India in the financial year 2023-24, as per the First Advance Estimates (FAEs)?

A. 6.5%

B. 7.2%

C. 7.3%

D. 8.0%

-

When are the Subsequent Releases of GDP estimates expected, following the First Advance Estimates (FAEs)?

A. March

B. May

C. February

D. January

-

Why do the First Advance Estimates (FAEs) hold particular importance in the context of India’s economic planning?

A. They determine interest rates.

B. They shape the Union Budget.

C. They influence inflation rates.

D. They guide foreign trade policies.

-

What is the main concern regarding government spending in the second term, as highlighted in the essay?

A. Excessive spending leading to inflation.

B. Unequal distribution of spending across regions.

C. Limited spending growth despite disruptions.

D. Overspending on non-essential sectors.

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()