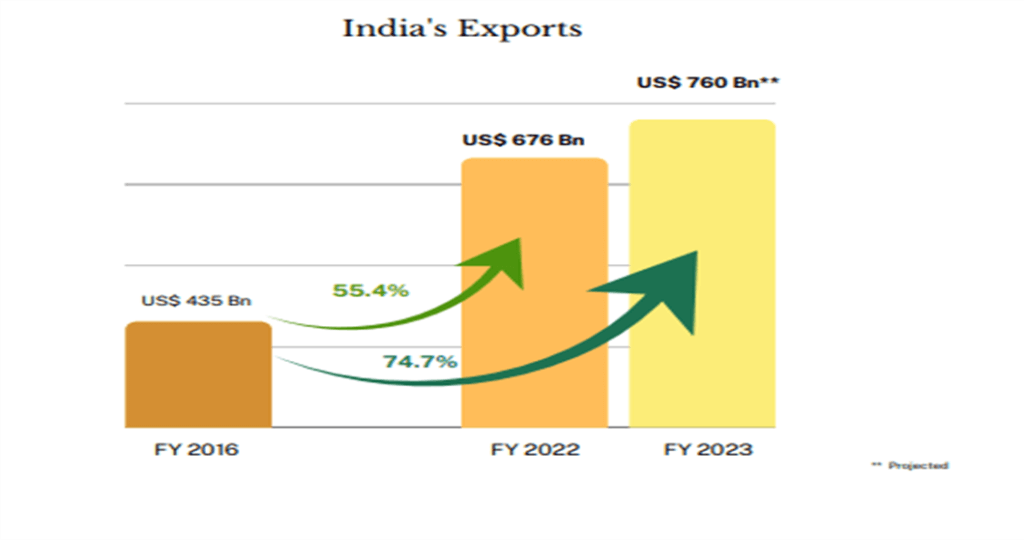

On March 31st, 2023, the Union Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution, and Textiles launched the Foreign Trade Policy 2023. This new policy aims to almost triple India’s goods and services exports to $2 trillion by 2030, from an estimated $760 billion in 2022-23. The new policy has replaced the old policy that had been in place since 2015.

Provisions:

The new policy will have no sunset date (ending date) and will be tweaked based on the emerging world trade scenario and industry feedback. While the policy will be open-ended, the schemes sanctioned under it will be time-bound. There are no major new schemes, barring a one-time amnesty under the existing Advance Authorisation and Export Promotion Capital Goods (EPCG) schemes, that allow imports of capital goods subject to specified export obligations.

The policy had opened up a new area of potential exports called “merchanting trade” that involves an Indian intermediary shipping goods from one foreign country to another foreign country without touching Indian ports.

Challenges:

Indian exporters face several challenges that hinder their export potential. The low access to trade finance and export credit is a significant problem, especially for Micro, Small, and Medium Enterprises (MSMEs), even though they account for close to half of India’s total exports. Indian exporters must also deal with a high documentation requirement, which makes the export process more time-consuming than in many other countries. Additionally, India’s infrastructure is inadequate compared to other countries.

Initiatives for Improving Exports:

- The government has introduced initiatives to improve exports in India.

- Remission of Duties or Taxes on Export Product (RoDTEP) is a fully automated route for Input Tax Credit (ITC) in the GST that helps increase exports in India.

- Rebate of State and Central Taxes and Levies was introduced by the Ministry of Textiles for embedded state and central duties and taxes that are not refunded through GST.

- Merchandise Exports from India Scheme (MEIS) provides duty benefits depending on the product and country.

- Common Digital Platform for Certificate of Origin has been launched to facilitate trade and increase Free Trade Agreement (FTA) utilization by exporters.

Why In News

The Union Minister of Commerce and Industry, Consumer Affairs, Food and Public Distribution and Textiles launched the Foreign Trade Policy 2023 with the aim of making India a leader in international trade. The policy aims to address the challenges faced by Indian exporters and to increase the country’s share in global trade. It includes several initiatives, such as the Remission of Duties or Taxes on Export Product (RoDTEP), Rebate of State and Central Taxes and Levies, Merchandise Exports from India Scheme (MEIS), and the Common Digital Platform for Certificate of Origin, to support and promote exports from India.

MCQs on Key Provisions of India’s New Foreign Trade Policy 2023

-

Which of the following initiatives is a fully automated route for Input Tax Credit (ITC) in the GST (Goods and Service Tax) that helps increase exports in India?

A. Remission of Duties or Taxes on Export Product (RoDTEP)

B. Rebate of State and Central Taxes and Levies

C. Merchandise Exports from India Scheme (MEIS)

D. Common Digital Platform for Certificate of Origin

-

Which initiative was introduced by the Ministry of Textiles for embedded state and central duties and taxes that are not refunded through GST?

A. Remission of Duties or Taxes on Export Product (RoDTEP)

B. Rebate of State and Central Taxes and Levies

C. Merchandise Exports from India Scheme (MEIS)

D. Common Digital Platform for Certificate of Origin

-

Which initiative provides duty benefits depending on the product and country?

A. Remission of Duties or Taxes on Export Product (RoDTEP)

B. Rebate of State and Central Taxes and Levies

C. Merchandise Exports from India Scheme (MEIS)

D. Common Digital Platform for Certificate of Origin

-

Which initiative has been launched to facilitate trade and increase Free Trade Agreement (FTA) utilization by exporters?

A. Remission of Duties or Taxes on Export Product (RoDTEP)

B. Rebate of State and Central Taxes and Levies

C. Merchandise Exports from India Scheme (MEIS)

D. Common Digital Platform for Certificate of Origin

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()