The Prevention of Money Laundering Act (PMLA) has been amended to include chartered accountants, company secretaries, and cost and works accountants who carry out financial transactions on behalf of their clients. The recent changes were made in line with the recommendations of the Financial Action Task Force (FATF). The amendment recognizes any financial activity carried out by these professionals on behalf of their clients, such as buying and selling of immovable property, managing client money, securities or other assets, and organization of contributions for the creation, operation, or management of companies.

Reporting Entities and Compliance

Under the amended PMLA, the financial professionals who have obtained certificates of practice as chartered accountants, company secretaries, and cost and work accountants would be defined as relevant persons for reporting transactions on behalf of their individual clients.

The reporting entities are expected to maintain records of all transactions and to conduct KYC before commencing each specified transaction. They will also have to examine the ownership and financial position, including sources of funds of the client, and record the purpose behind conducting the specified transaction.

Criticism of the Amendment

Tax experts have criticized the amendment, citing onerous compliance and low conviction rates under the law. The inclusion of CAs, CSs, and CWAs was deemed unnecessary and could lead to potential run-ins with investigative agencies such as the Enforcement Directorate (ED).

Other Recent Changes

In March, the government had widened the ambit of reporting entities under money laundering provisions to incorporate more disclosures for non-governmental organizations and define politically exposed persons (PEPs).

The PMLA, 2002

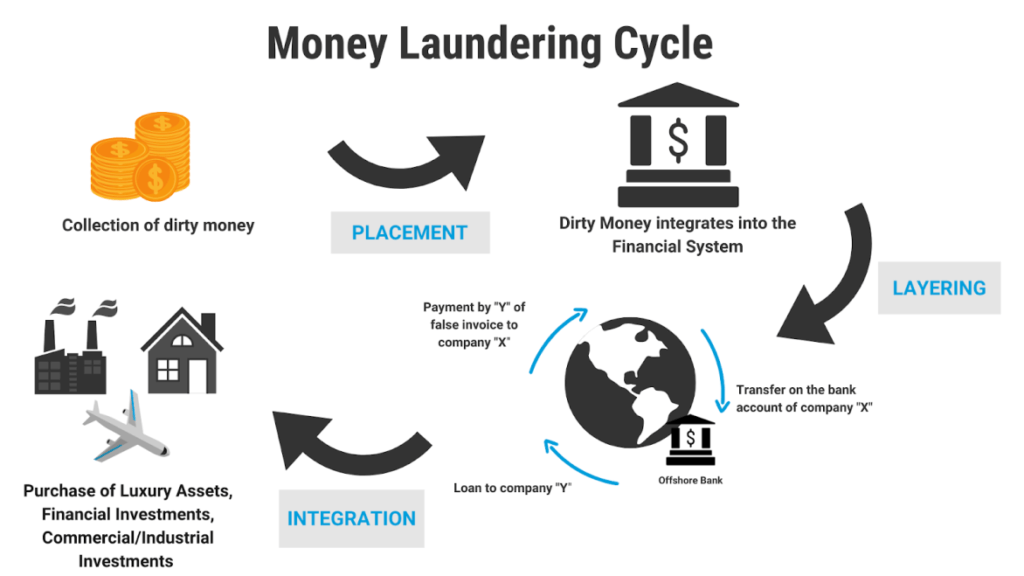

The Parliament enacted the PMLA to deal with the menace of money laundering of proceeds of a crime having transnational consequences on the financial systems of the countries. The act has three main objectives: to prevent and control money laundering, to confiscate and seize the property obtained from the laundered money, and to deal with any other issue connected with money laundering in India.

Important Points:

👉 The Prevention of Money Laundering Act (PMLA) has been amended to include financial professionals such as chartered accountants, company secretaries, and cost and works accountants who carry out financial transactions on behalf of their clients.

👉 The recent changes to the PMLA were made in line with the recommendations of the Financial Action Task Force (FATF).

👉 The amended PMLA recognizes any financial activity carried out by these professionals on behalf of their clients, including buying and selling of immovable property, managing client money, securities or other assets, and organization of contributions for the creation, operation, or management of companies.

👉 Reporting entities, including financial professionals who have obtained certificates of practice, are expected to maintain records of all transactions and to conduct KYC before commencing each specified transaction.

👉 Tax experts have criticized the amendment, citing onerous compliance and low conviction rates under the law.

👉 The inclusion of chartered accountants, company secretaries, and cost and works accountants in the amended PMLA has raised concerns among financial professionals who could face penalties for non-compliance and potential run-ins with investigative agencies such as the Enforcement Directorate (ED).

👉 In March, the government widened the ambit of reporting entities under money laundering provisions to incorporate more disclosures for non-governmental organizations and define politically exposed persons (PEPs).

👉 The Parliament enacted the PMLA to deal with the menace of money laundering of proceeds of a crime having transnational consequences on the financial systems of the countries.

👉 The PMLA has three main objectives: to prevent and control money laundering, to confiscate and seize the property obtained from the laundered money, and to deal with any other issue connected with money laundering in India.

Why In News

As per recent amendments to the Prevention of Money Laundering Act (PMLA), financial professionals such as chartered accountants, company secretaries, and cost and works accountants who conduct financial transactions on behalf of their clients are now within the scope of the Act.

MCQs about Prevention of Money Laundering Act

-

Which financial professionals are now under the ambit of the Prevention of Money Laundering Act (PMLA)?

A. Chartered accountants, Company secretaries, and cost and works accountants

B. Bank tellers

C. Retail sales associates

D. Restaurant servers

-

What is the main objective of the Prevention of Money Laundering Act (PMLA)?

A. To combat money laundering in India

B. To promote money laundering in India

C. To legalize money laundering in India

D. To ignore money laundering in India

-

What are the concerns amongst financial professionals regarding the recent amendment under the PMLA?

A. They could possibly face penalty for non-compliance

B. They could possibly receive a promotion for non-compliance

C. They could possibly receive a reward for non-compliance

D. They could possibly receive a medal for non-compliance

-

What recent changes have been made to the money laundering provisions in India?

A. The government had widened the ambit of reporting entities to incorporate more disclosures for non-governmental organizations and defined politically exposed persons (PEPs)

B. The government had narrowed the ambit of reporting entities to exclude more disclosures for non-governmental organizations and defined politically exposed persons (PEPs)

C. The government had abolished the Prevention of Money Laundering Act (PMLA)

D. The government had increased the threshold for money laundering activities

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()