The Reserve Bank of India (RBI) recently issued detailed guidelines for banks and non-banking financial companies (NBFCs) to accept ‘green deposits.’ These funds will be utilized to finance activities in renewable energy, green transport, and green buildings. Let’s dive deeper into this development and understand its implications for the Indian economy.

Framework for Green Deposits

The framework will come into effect from June 1, 2023, and will cover Scheduled Commercial Banks, including Small Finance Banks (SFBs), Local Area Banks, Payments Banks, and all deposit-taking NBFCs, including Housing Finance Companies.

The funds raised through green deposits will be allocated towards activities and projects that promote energy efficiency, reduce greenhouse gas emissions, improve natural ecosystems and biodiversity, and promote climate resilience/adaptation. However, certain activities such as nuclear power, direct waste incineration, alcohol, weapons, tobacco, gaming, or palm oil industries will be excluded.

The Framework

Regulated Entities (REs) must develop a Board-approved Financing Framework (FF). The green deposits shall be in Indian Rupees only, and the allocation of funds shall be subject to independent third-party verification/assurance conducted annually.

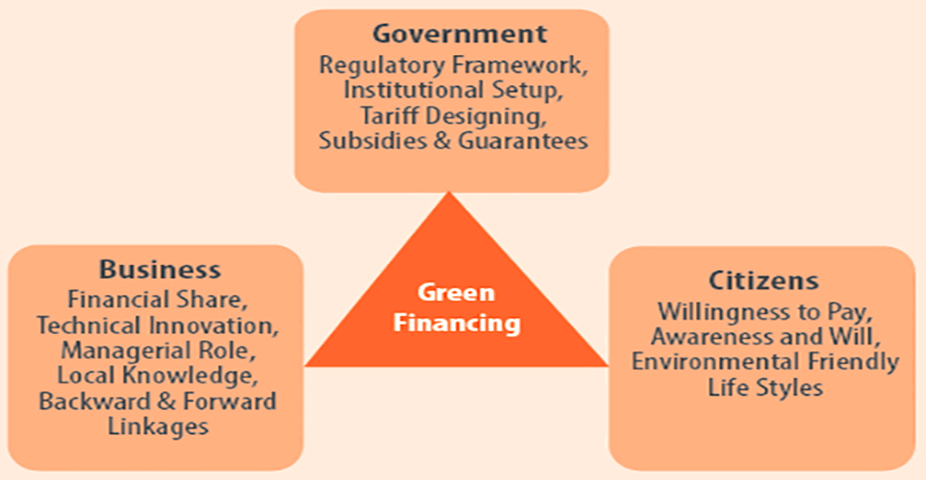

Green Finance Ecosystem

The Green Finance Ecosystem is the financial ecosystem that supports investments in environmentally sustainable projects and activities. It includes a plethora of financial products such as green bonds, green loans, green insurance, and green funds. It aims to create a low-carbon, resource-efficient, and sustainable economy, while also addressing the risks and opportunities associated with environmental issues such as climate change, pollution, and biodiversity loss.

Need for Green Finance

Green finance promotes sustainable development and creates a positive impact on the environment. India has committed to achieving net-zero emissions by 2070. The Green Deal states green finance as an enabler to accelerate decarbonization. In 2016, the RBI along with the United Nations Environment Programme (UNEP) reported that India is on the lines of sustainable financial systems.

Government Initiatives

The Indian government has taken several initiatives to promote green finance, such as carbon trading through the ‘Perform Achieve and Trade’ (PAT) scheme, allowing 100% FDI under the automatic route in the renewable energy sector, waiving Inter-State Transmission System (ISTS) charges for inter-state sale of solar and wind power for projects, provisions for Renewable Purchase Obligation (RPO), and Renewable Energy Parks. Additionally, the National Hydrogen Mission has been announced, and India has set its Nationally Determined Contribution under the Paris Agreement with quantified targets.

Way Forward

The green economy has a lot of potential and is showing promising signs of growth. Promoting sustainable finance through both institutional and informal means will enable the country’s transition towards a low-carbon, resource-efficient, and sustainable economy. The RBI’s guidelines for accepting green deposits will go a long way in promoting green finance and supporting India’s transition towards a sustainable future.

Why In News

The Reserve Bank of India (RBI) released detailed guidelines in April 2023, allowing banks and non-banking financial companies (NBFCs) to accept ‘green deposits’ that can be allocated towards financing environmentally sustainable projects in areas such as renewable energy, green transport, and green buildings.

MCQs about Role of Green Finance in India

-

The RBI’s guidelines for ‘green deposits’ are applicable to which of the following entities?

A. Scheduled Commercial Banks and deposit-taking NBFCs

B. Regional Rural Banks and Payments Banks

C. Scheduled Commercial Banks and Regional Rural Banks

D. Local Area Banks and Housing Finance Companies

-

What is the primary purpose of the framework for ‘green deposits’ issued by the RBI?

A. To promote the use of green transport

B. To encourage investments in nuclear power projects

C. To promote financing of activities related to renewable energy, green transport, and green buildings

D. To provide a framework for investing in the palm oil industry

-

Which of the following activities are excluded from the scope of the framework for ‘green deposits’?

A. Activities involving new or existing extraction, production, and distribution of fossil fuels

B. Renewable energy projects generating energy from biomass using feedstock originating from protected areas

C. Hydropower plants larger than 25 MW

D. Both A and B

-

What is the objective of the Green Finance Ecosystem?

A. To support investments in environmentally sustainable projects and activities

B. To promote the use of fossil fuels

C. To create a high-carbon, resource-inefficient, and unsustainable economy

D. None of the above

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()