Daily Current Affairs : 18-July-2024

The Securities and Exchange Board of India (SEBI) has recently proposed a new asset class aimed at high-risk investors, giving them access to more sophisticated financial strategies. This move is expected to include investments in products like long-short equity funds and inverse Exchange-Traded Funds (ETFs). Let’s explore these concepts and understand their potential impact.

What is an ETF?

An Exchange-Traded Fund (ETF) is a type of investment fund that holds a collection of assets such as stocks, bonds, or commodities. It is traded on a stock exchange, much like a regular stock.

Key Features of ETFs:

- Diversification: An ETF allows investors to diversify their portfolios with a single investment. This means you can invest in a wide variety of assets without having to buy them individually.

- Lower Fees: Compared to mutual funds, ETFs generally come with lower management fees, making them a cost-effective option for many investors.

- Ease of Trading: ETFs can be bought and sold on stock exchanges during trading hours, offering flexibility similar to stocks.

What is an Inverse ETF?

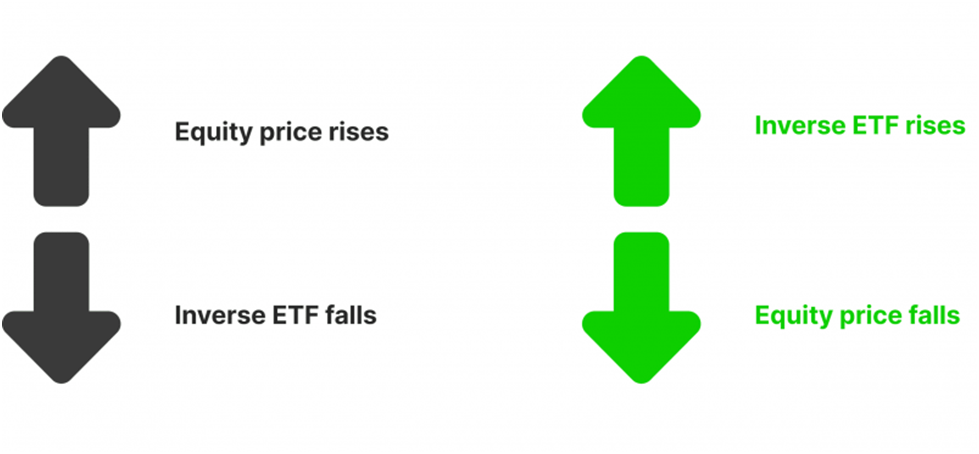

An Inverse ETF is a specialized type of ETF that aims to move in the opposite direction of a particular market index or benchmark.

How Does It Work?

- If the market or a specific index falls, the value of an inverse ETF typically rises.

- The goal of an inverse ETF is to help investors profit from market declines, which can be useful in bear markets or during economic downturns.

Inverse ETFs are designed for investors who believe that certain markets will decline and are looking to capitalize on that trend. However, they come with higher risk due to their complex nature.

SEBI’s New Proposal

SEBI’s proposal to introduce such investment strategies, including long-short equity funds and inverse ETFs, aims to provide high-risk investors with more advanced ways to manage their portfolios. These strategies can potentially enhance returns but also involve significant risk.

- Long-Short Equity Funds: These funds involve buying stocks that are expected to rise in value and short-selling stocks that are expected to fall.

- Inverse ETFs: As mentioned, these funds allow investors to bet against the market.

By providing access to these strategies, SEBI hopes to offer investors more flexibility and opportunities, though it will likely appeal mostly to those willing to take on higher risks.

Important Points:

SEBI’s Proposal: SEBI has proposed a new asset class aimed at high-risk investors, offering access to advanced strategies like long-short equity funds and inverse ETFs.

What is an ETF?

- An ETF is an investment fund that holds a collection of assets (stocks, bonds, commodities) and is traded on stock exchanges.

- Key Features:

- Diversification: Offers broad market exposure with a single investment.

- Lower Fees: Generally has lower management fees compared to mutual funds.

- Ease of Trading: Can be bought and sold like regular stocks during market hours.

What is an Inverse ETF?

- An inverse ETF aims to provide returns that move in the opposite direction of a specific market index.

- How it Works:

- If the underlying market or index falls, the inverse ETF typically rises.

- It allows investors to profit from a market downturn or bear market.

- Inverse ETFs carry higher risks due to their complex nature.

SEBI’s New Proposal:

- SEBI is introducing strategies like long-short equity funds and inverse ETFs to provide more advanced portfolio management tools for high-risk investors.

- Long-Short Equity Funds: Involves buying stocks expected to rise in value and short-selling those expected to fall.

- Inverse ETFs: Allows investors to bet against the market, profiting from declines.

Target Audience: These strategies are designed for investors who are willing to take on higher risks, providing more flexibility but also significant risk.

Why In News

SEBI’s new asset class proposal for high-risk investors is expected to provide access to advanced strategies like long-short equity funds and inverse ETFs, enabling investors to explore more dynamic ways of managing their portfolios and potentially enhancing returns in volatile markets.

MCQs about Sebi’s Proposal for High-Risk Investors

-

What is the primary purpose of SEBI’s new asset class proposal for high-risk investors?

A. To introduce low-risk investment products

B. To provide access to advanced investment strategies like long-short equity funds and inverse ETFs

C. To eliminate the need for stock exchanges

D. To regulate mutual funds more strictly

-

What is a key feature of an Exchange-Traded Fund (ETF)?

A. It is only available for purchase by institutional investors

B. It offers a way to invest in a single asset

C. It provides diversification by holding a collection of assets like stocks, bonds, or commodities

D. It is a type of insurance product

-

How does an Inverse ETF work?

A. It tracks the performance of a market index by moving in the same direction

B. It provides returns that move in the opposite direction of a specific market index

C. It only performs well during economic booms

D. It guarantees returns regardless of market conditions

-

Who are the ideal investors for strategies like long-short equity funds and inverse ETFs?

A. Conservative investors with low risk tolerance

B. Investors who want guaranteed returns with no risk

C. High-risk investors seeking advanced portfolio management strategies

D. Investors looking for short-term savings accounts

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()