Daily Current Affairs : 4-August-2023

In an effort to streamline contractual disputes involving the government and its undertakings, the Centre has introduced the ‘Vivad se Vishwas II – Contractual Disputes’ settlement scheme. This scheme, which was outlined in this year’s Union Budget, aims to bring a final resolution to such disputes through a unique “one-time settlement” approach. Let’s delve into the key details and implications of this significant initiative.

Understanding the Vivad se Vishwas II Scheme

The Vivad se Vishwas II scheme is designed to address contractual disputes between the government and its partners, where a legal challenge has been raised against an arbitral award. The scheme introduces a graded system for settling disputes, taking into account the extent of the pending legal process. Here are some crucial aspects of the scheme:

- Scope and Applicability: The scheme encompasses domestic contractual disputes involving the Government of India or its controlled organizations as one of the parties.

- Settlement Terms: Depending on the type of award (court award or arbitral award), the settlement amount offered to the contractor varies. For court awards, it can go up to 85% of the net amount awarded or upheld by the court. In the case of arbitral awards, the threshold is up to 65% of the net amount.

- Time Frame: The scheme covers disputes that have arisen until 30 September 2022, promoting the ease of doing business in the country.

- Implementation through GeM Portal: To ensure a smooth and transparent process, the Government e-Marketplace (GeM) portal will be used for implementing the scheme. A dedicated web page has been created on the GeM platform to facilitate the implementation of Vivad se Vishwas II for Contractual Disputes.

- Exclusivity of Claims Processing: Claims eligible under the scheme will be exclusively processed through the GeM platform, expediting the resolution process and ensuring fairness.

Eligibility and Conditions for Settlement

It’s important to note that certain conditions must be met to be eligible for a one-time settlement under this scheme. The dispute should not involve any state government or private firm, and it should pertain to pending financial claims rather than performance-related claims.

The Wider Context: Vivad se Vishwas Scheme

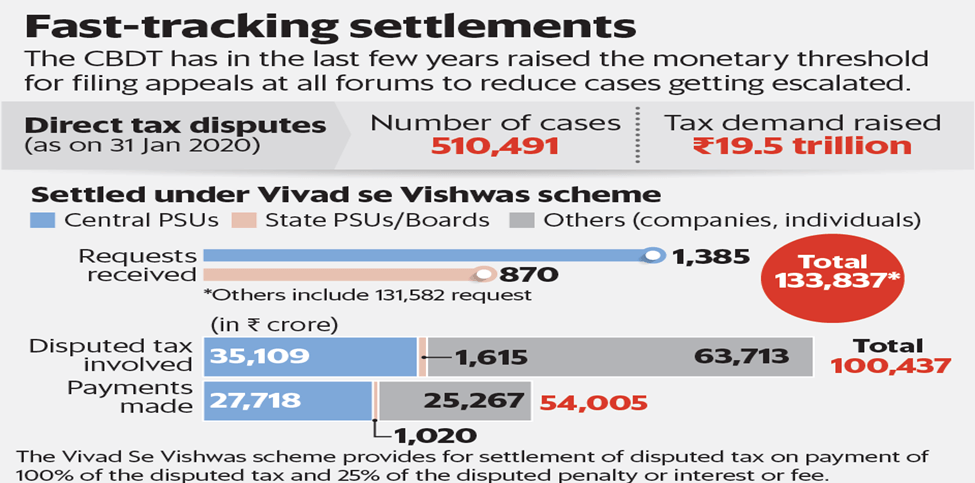

The newly introduced Vivad se Vishwas II scheme for contractual disputes draws inspiration from the original Vivad se Vishwas Scheme, which focuses on ongoing legal tax disputes. Under the original scheme:

- Taxpayers embroiled in tax-related legal disputes can benefit from a complete waiver of interest and penalties associated with the disputed tax amount.

- This implies that the taxpayer is only required to pay the actual disputed tax amount, providing a significant relief from additional financial burdens.

Important Points:

- The Centre launched the ‘Vivad se Vishwas II – Contractual Disputes’ settlement scheme to address contractual disputes involving the government and its undertakings.

- The scheme aims to provide a final resolution to disputes through a “one-time settlement” approach.

- It applies to domestic contractual disputes where one party is the Government of India or an organization under its control.

- Graded settlement terms are offered based on the type of award – court award or arbitral award – and the pending legal process.

- Settlement amount can go up to 85% of the net amount awarded or upheld by the court for court awards.

- For arbitral awards, the threshold is up to 65% of the net amount.

- The scheme covers disputes up to 30 September 2022, enhancing the ease of doing business.

- Implementation is facilitated through the Government e-Marketplace (GeM) portal for transparency.

- A dedicated web page on GeM platform streamlines claims processing and ensures swift resolution.

- Eligible claims exclusively processed through GeM, excluding state governments or private firms involvement.

- Disputes should be related to pending financial claims rather than performance claims.

- The scheme draws inspiration from the original Vivad se Vishwas Scheme, which addresses ongoing tax disputes.

- Under the original scheme, taxpayers receive a waiver of interest and penalties associated with disputed tax, paying only the disputed tax amount.

Significance and Implications

- The scheme simplifies contractual dispute resolution involving the government, promoting ease of doing business.

- Utilizing the GeM platform enhances transparency and efficiency in settling disputes.

- Vivad se Vishwas II contributes to a more streamlined legal ecosystem by providing a structured approach to settlement.

- The initiative offers relief to disputing parties while fostering a transparent and efficient business environment in the country.

Why In News

Recently, the Centre introduced a pioneering settlement scheme aimed at effectively resolving contractual disputes that may arise between vendors or suppliers and the government and its undertakings. This progressive initiative not only promotes fair and timely resolution of conflicts but also underscores the government’s commitment to fostering a transparent and conducive business environment.

MCQs about Vivad se Vishwas II

-

What is the main objective of the ‘Vivad se Vishwas II – Contractual Disputes’ scheme?

A. To increase taxes for businesses involved in disputes.

B. To provide a platform for performance-related claims.

C. To offer a final resolution to contractual disputes involving the government.

D. To waive all taxes for disputing parties.

-

Which organization’s portal will be utilized for the implementation of the ‘Vivad se Vishwas II – Contractual Disputes’ scheme?

A. Government Taxation Portal

B. National Legal Dispute Platform

C. GeM Portal

D. Business Resolution Network

-

What is the key benefit of the original ‘Vivad se Vishwas’ scheme for taxpayers involved in tax disputes?

A. Complete waiver of disputed tax amount

B. Exemption from filing taxes

C. Reduction in legal penalties

D. Refund of interest on disputed tax

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()