Daily Current Affairs : 6-July-2024

Stablecoins have become a key part of the cryptocurrency environment. These digital assets are designed to offer stability by being pegged to a real-world asset, such as a fiat currency or commodity. However, recent events, such as the collapse of TerraUSD, have highlighted some of the challenges and risks that stablecoins face in the market. In this essay, we will explore what stablecoins are, the different types available, and the concerns surrounding their use.

What Are Stablecoins?

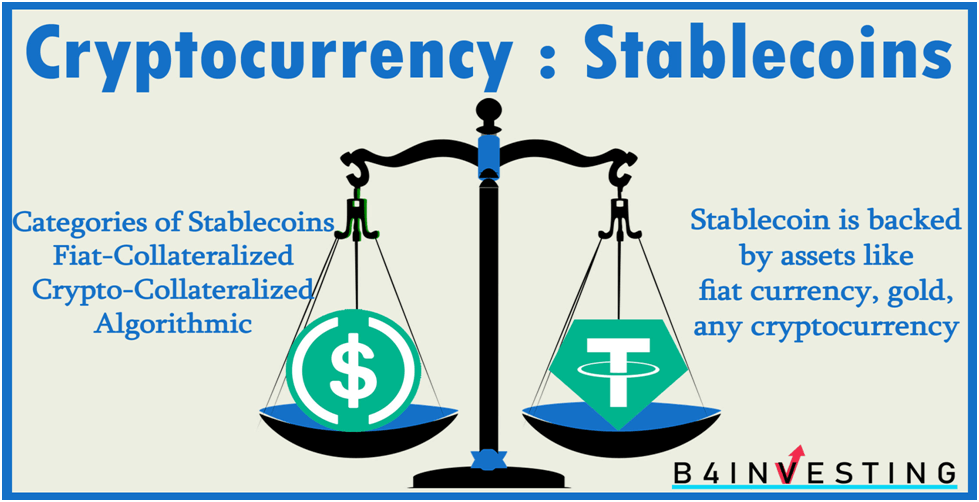

Stablecoins are a type of cryptocurrency created to maintain a stable value, unlike traditional cryptocurrencies such as Bitcoin or Ethereum, which are highly volatile. To achieve this stability, stablecoins are generally pegged to assets like fiat currencies, commodities, or even other cryptocurrencies. By linking their value to these assets, stablecoins aim to reduce price fluctuations, making them more suitable for regular transactions and as a store of value.

Types of Stablecoins

There are several different types of stablecoins, each with its unique features:

- Fiat-Collateralized Stablecoins: These are backed 1:1 by a fiat currency such as the US dollar or Euro. Examples include Tether (USDT) and Gemini Dollar (GUSD).

- Asset-Backed Stablecoins: These stablecoins are backed by a basket of assets like precious metals or commodities. Digix Gold (DGX) is an example of an asset-backed stablecoin.

- Crypto-Collateralized Stablecoins: These stablecoins are decentralized and backed by other cryptocurrencies. They are often over-collateralized to absorb market fluctuations. An example is Dai (DAI).

- Non-Collateralized Stablecoins: These stablecoins are not backed by any physical assets but are governed by algorithms to manage supply and demand. Basis was one such example, though it is no longer operational.

Concerns and Challenges

While stablecoins offer stability in theory, there are several concerns about their effectiveness and long-term viability:

- Market Volatility: Even stablecoins can experience price fluctuations, as seen with the collapse of TerraUSD.

- Short-Term Debt Risks: Some stablecoins rely on short-term debt, which could be risky in times of market stress.

- Contagion and Financial Stability: The failure of one major stablecoin could cause ripple effects throughout the broader financial system, threatening the stability of other digital assets.

- Transparency Issues: Some stablecoins lack transparency about how they are backed or how their value is managed.

- Regulatory Uncertainty: There is no clear regulatory framework for stablecoins, which leaves the market exposed to potential risks and challenges.

Important Points:

- Definition of Stablecoins:

- Digital cryptocurrencies designed to maintain a stable value.

- Pegged to real-world assets like fiat currencies, commodities, or other cryptocurrencies.

- Types of Stablecoins:

- Fiat-Collateralized Stablecoins: Backed 1:1 by fiat currencies (e.g., Tether, Gemini Dollar).

- Asset-Backed Stablecoins: Supported by assets like precious metals or commodities (e.g., Digix Gold).

- Crypto-Collateralized Stablecoins: Backed by cryptocurrencies, often over-collateralized to mitigate volatility (e.g., Dai).

- Non-Collateralized Stablecoins: Governed by algorithms without specific backing (e.g., Basis).

- Advantages of Stablecoins:

- Offer stability in a volatile cryptocurrency market.

- Suitable for transactions and as a store of value.

- Concerns and Challenges:

- Market Volatility: Stablecoins can still experience price fluctuations, as seen with TerraUSD’s collapse.

- Short-Term Debt Risks: Some stablecoins depend on short-term debt, which can be risky in market stress.

- Contagion Risks: Failure of one major stablecoin could affect the broader financial system.

- Transparency Issues: Some stablecoins lack clear information on how they are backed or managed.

- Regulatory Uncertainty: There is no clear regulatory framework, creating risks for the market.

- Need for Regulation:

- Cooperation between the stablecoin industry and regulators is crucial to ensure stability and innovation.

- Effective regulation can help avoid market disruptions while promoting growth.

Why In News

Recent volatility in the stablecoin market, such as the collapse of TerraUSD, has drawn significant attention to the vulnerabilities and risks associated with these digital assets. This has raised important questions about their long-term stability, transparency, and the effectiveness of their underlying mechanisms.

MCQs about Stablecoins and Their Role in the Cryptocurrency Market

-

What is the primary goal of stablecoins?

A. To increase price volatility

B. To maintain a stable value

C. To decentralize financial systems

D. To replace traditional currencies

-

Which of the following is an example of a fiat-collateralized stablecoin?

A. Dai

B. Tether

C. Digix Gold

D. Basis

-

What is a major concern regarding the stability of stablecoins?

A. They are too widely used

B. They rely on long-term debt

C. They can still experience price fluctuations

D. They are not decentralized

-

What role does regulation play in the future of stablecoins?

A. To eliminate stablecoins from the market

B. To ensure the safe development of stablecoins without stifling innovation

C. To prevent stablecoins from being used for transactions

D. To prevent all cryptocurrencies from functioning

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()