The Insurance Regulatory Development Authority (IRDA) is taking a revolutionary step in the insurance sector by devising an all-in-one affordable single policy. This policy aims to provide citizens with comprehensive protection against health, life, property, and accident risks while expediting claim settlements through the integration of death registries onto a common industry platform. This essay explores the potential impact of this policy, its aim to address protection gaps, and its significance in revolutionizing the insurance sector.

Addressing Protection Gaps:

- Insurance penetration challenges: Despite advancements, significant protection gaps exist across various insurance lines, including life, health, motor, property, and crops.

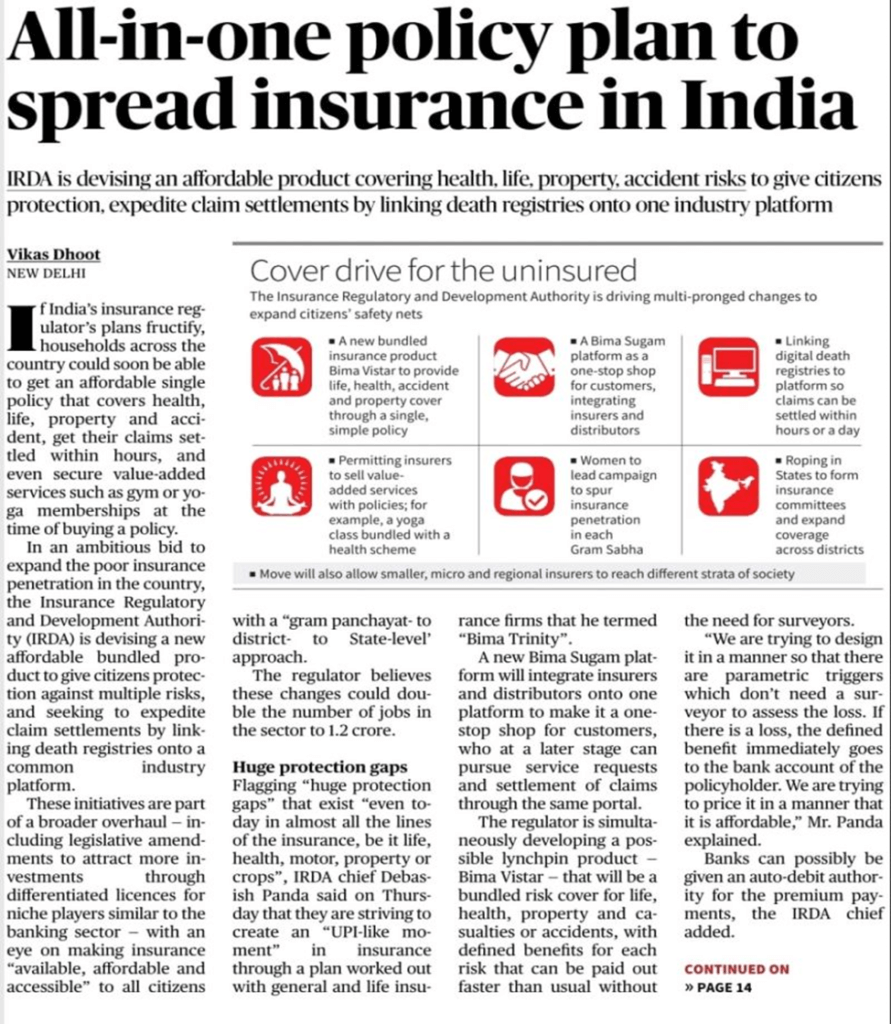

- The Bima Sugam platform: The IRDA plans to launch the Bima Sugam platform, which will integrate insurers and distributors into a one-stop shop for customers.

- Simplified access: Customers will have easier access to a wide range of insurance products.

- Service and claims settlement: The platform will enable customers to pursue service requests and settle claims conveniently.

- Bima Vistar: IRDA is developing a lynchpin product called Bima Vistar, which will offer a bundled risk cover for life, health, property, and accidents.

- Comprehensive coverage: Bima Vistar will cater to various risks, providing citizens with a holistic insurance solution.

- Women-centric workforce: IRDA envisions a women-centric workforce of Bima Vaahaks (carriers) in each Gram Sabha to promote the benefits of composite insurance products like Bima Vistar.

Expedited Claim Settlements:

- Integration with registries: With many states digitizing their birth and death registries, integrating the IRDA platform with these registries could enable faster claim settlements, potentially within a day.

- Streamlined processes: The common industry platform will facilitate seamless communication between insurers, distributors, and customers, reducing claim processing times.

- Gram Sabha to district to state approach: The policy’s implementation will follow a decentralized approach, ensuring efficient coordination at different levels and expediting claim settlements.

The Policy as a Game Changer:

- Universal insurance coverage: The single policy aspires to provide insurance cover for all citizens by 2047, thereby addressing the existing protection gaps.

- State-level insurance committees: IRDA aims to establish State-level insurance committees, similar to those in the banking sector, to formulate district-level plans and collaborate with State governments.

- Amendments to insurance laws: Proposed amendments will allow differentiated capital requirements for niche insurers, attracting more investments and encouraging the entry of new players such as micro, regional, specialized, and composite license insurers.

- Geographical and demographic inclusivity: The new policy will cater to the diverse needs of different geographies and population strata, promoting inclusivity in insurance coverage.

Important Points:

- 🔄 All-in-one affordable single policy: IRDA is developing a bundled product to provide citizens with comprehensive coverage against health, life, property, and accident risks.

- 🚀 Addressing protection gaps: The policy aims to bridge significant gaps in insurance coverage across various lines, including life, health, motor, property, and crops.

- 💻 Bima Sugam platform: Integration of insurers and distributors onto one platform, creating a convenient one-stop shop for customers.

- 📝 Streamlined processes: The platform allows customers to pursue service requests and settle claims easily, enhancing efficiency and convenience.

- 🤝 Bima Vistar: A comprehensive bundled risk cover for life, health, property, and accidents, catering to different risk factors.

- 👩💼 Women-centric workforce: Introducing Bima Vaahaks (carriers) at the Gram Sabha level to engage with women heads of households and promote composite insurance products like Bima Vistar.

- 🏛️ Integration with registries: Linking death registries to the industry platform enables fast claim settlements, potentially within a day.

- 🌍 Universal insurance coverage: The policy aspires to provide insurance cover for all citizens by 2047, ensuring inclusivity and reducing protection gaps.

- 📝 Amendments to insurance laws: Proposed changes would allow differentiated capital requirements, encouraging new players and attracting investments.

- 🏢 State-level insurance committees: Establishing committees similar to the banking sector to collaborate with State governments and formulate district-level plans.

- 📈 Growth in insurance sector: The policy changes are expected to double the number of jobs in the insurance industry to 1.2 crore.

- 🌐 Geographical and demographic inclusivity: The policy caters to the diverse needs of different geographies and population strata, promoting accessibility to insurance coverage.

- 💥 A game-changer in insurance: The policy’s comprehensive approach and transformative impact likened to the Unified Payments Interface (UPI) in the financial sector.

Why In News

The Insurance Regulatory and Development Authority (IRDA) is currently working on a comprehensive and affordable single policy that provides coverage for health, life, property, and accident risks. This initiative aims to safeguard citizens by streamlining claim settlements through the integration of death registries into a unified industry platform, ensuring efficient and prompt assistance during times of need. Additionally, the IRDA’s integrated policy will simplify insurance management for individuals, offering them peace of mind and comprehensive protection in a single package.

MCQs about The All-in-One Affordable Single Policy

-

What is the main objective of the Insurance Regulatory Development Authority (IRDA) in devising the all-in-one affordable single policy?

A. Increase insurance penetration in the country

B. Expedite claim settlements

C. Attract more investments in the insurance sector

D. All of the above

-

Which platform integrates insurers and distributors to create a one-stop shop for customers?

A. Bima Sugam platform

B. Bima Vistar platform

C. Bima Vaahaks platform

D. IRDA platform

-

What is the envisioned role of Bima Vaahaks in the insurance sector?

A. Meeting the women heads of households to promote composite insurance products

B. Streamlining claim settlement processes

C. Developing district-level insurance plans

D. Providing differentiated capital requirements for niche insurers

-

How does the integration with death registries contribute to claim settlements?

A. Enables faster claim settlements within a day

B. Streamlines communication between insurers, distributors, and customers

C. Reduces protection gaps in insurance coverage

D. Attracts more investments in the insurance sector

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()