Recently, Credit Suisse, a Swiss bank, made headlines by purchasing Ecuadorian bonds at discounted rates through a debt-for-nature swap. This move has important implications for the environment and is worth exploring, especially for those preparing for the IAS exam’s environment segment in GS Paper III.

Understanding Debt-for-Nature Swaps

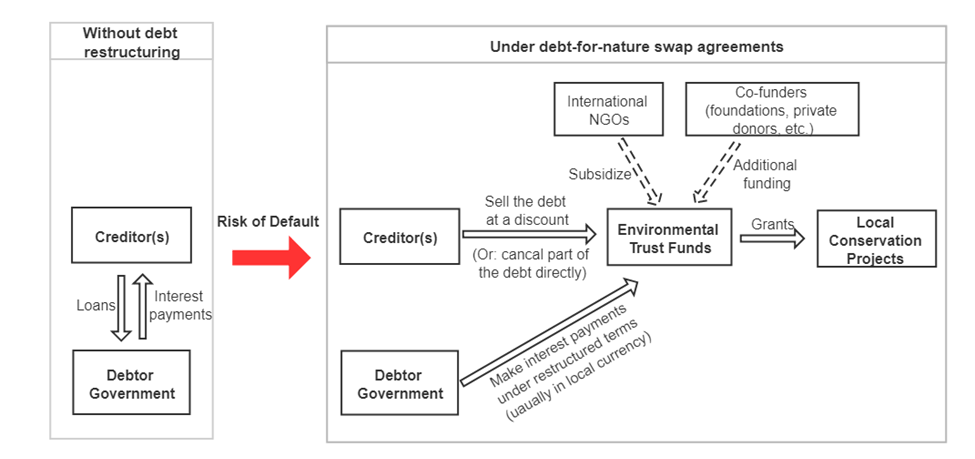

A debt-for-nature swap is a financial arrangement that benefits both debtor nations and creditors. In this arrangement, a debtor nation makes payments to a creditor, typically in a foreign currency, in exchange for the creditor’s agreement to channel debt-relief funds into conservation or reforestation programs in the debtor country. The main goal is to promote environmental conservation and sustainability while simultaneously relieving debt burdens.

Credit Suisse’s Acquisition of Ecuadorian Bonds

Credit Suisse, a prominent Swiss bank, has recently made a significant move in the financial market. The bank was acquired by Swiss banking giant UBS in an emergency takeover aimed at stabilizing the financial markets during a banking crisis. Due to the ongoing political crisis in Ecuador, where the National Assembly is attempting to impeach President Guillermo Lasso over allegations of embezzlement, the value of the country’s bonds has slumped. As a result, investors believed that non-payment was probable, leading to a decrease in bond prices. This situation presented an opportunity for Credit Suisse to step in and purchase the Ecuadorian bonds at discounted rates.

Details of the Deal

Credit Suisse has acquired Ecuadorian bonds worth $1.6 billion at less than half their original value through a debt-for-nature swap. In return, Ecuador has committed to investing $18 million annually for the next two decades in the conservation of the Galapagos Islands. The purchase of these bonds at a knock-down price was made possible by the slump in bond prices. The $656 million “Galapagos Bond” will replace the old debt and will be partly underwritten by the Inter-American Development Bank (IDB) and the US International Development Finance Corporation (IDFC). The IDB has approved a financial guarantee of $85 million for a debt swap of $800 million of Ecuador’s sovereign bonds.

Impact of the Deal

The commitment made by Ecuador to invest in the conservation of the Galapagos Islands will have a significant impact on the preservation of one of the world’s most precious ecosystems. The Galapagos Islands, located around 1,000 km west of Ecuador in the Pacific Ocean, are renowned for their extraordinary and varied wildlife that greatly influenced Charles Darwin’s evolutionary theory. Species such as the Galapagos tortoise, marine iguana, and Galapagos penguin call these islands their home.

The Galapagos Islands are known for their diverse biodiversity, which led to their designation as a UNESCO World Heritage site and a Biosphere Reserve. However, despite their remote location, these islands face environmental challenges, including climate change and invasive species, which put their fragile ecosystem at risk. Therefore, Ecuador’s commitment to investing in the conservation of the Galapagos Islands through the debt-for-nature swap is crucial in protecting this unique ecosystem.

Furthermore, the debt-for-nature swap has allowed Ecuador to repurchase its own debt at a lower price, reducing its overall debt burden. This demonstrates the potential of such swaps to not only protect valuable ecosystems but also provide economic benefits to debtor countries.

Important Points:

- 🌍 Debt-for-Nature Swap:

- Financial arrangement where debtor nation pays creditor in exchange for conservation or reforestation programs.

- Goal: Promote environmental conservation while relieving debt.

- 💰 Credit Suisse Buys Ecuadorian Bonds:

- Purchased bonds at discounted rates due to Ecuador’s political crisis.

- Bond prices decreased as non-payment seemed likely.

- 💼 Details of the Deal:

- Credit Suisse acquired Ecuadorian bonds worth $1.6 billion at less than half their original value.

- Ecuador committed to investing $18 million annually for 20 years in Galapagos conservation.

- $656 million “Galapagos Bond” to replace old debt, partly underwritten by IDB and IDFC.

- 🌱 Impact:

- Ecuador’s investment in Galapagos conservation protects a precious ecosystem.

- Debt-for-nature swap reduces Ecuador’s debt burden.

- Highlights potential of such swaps for environmental protection and economic benefits.

- 🐢 Galapagos Islands:

- Located west of Ecuador, known for unique wildlife and influenced Charles Darwin.

- Home to Galapagos tortoise, marine iguana, Galapagos penguin.

- Designated as UNESCO World Heritage site and Biosphere Reserve.

- Face challenges like climate change and invasive species.

Why In News

Credit Suisse’s Debt-for-Nature Swap: Unlocking Environmental Conservation and Galapagos Bond Investment in Ecuador

MCQs about Credit Suisse’s Debt-for-Nature Swap

-

What is a debt-for-nature swap?

A. A financial arrangement to stabilize banking markets during a crisis.

B. A program to promote tourism in debt-ridden nations.

C. An agreement where debt relief funds are used for conservation programs.

D. A strategy to increase a country’s debt burden.

-

Why did Credit Suisse purchase Ecuadorian bonds at discounted rates?

A. Due to the political crisis in Ecuador.

B. To destabilize the financial markets.

C. To increase Ecuador’s debt burden.

D. To promote environmental conservation.

-

What is the primary impact of Ecuador’s commitment to invest in Galapagos Island conservation?

A. Reduction of Ecuador’s debt burden.

B. Preservation of a precious ecosystem.

C. Stabilization of the banking markets.

D. Promotion of tourism in Ecuador.

-

Where are the Galapagos Islands located?

A. East of Ecuador in the Pacific Ocean.

B. North of Ecuador in the Atlantic Ocean.

C. West of Ecuador in the Pacific Ocean.

D. South of Ecuador in the Indian Ocean.

Boost up your confidence by appearing our Weekly Current Affairs Multiple Choice Questions

![]()